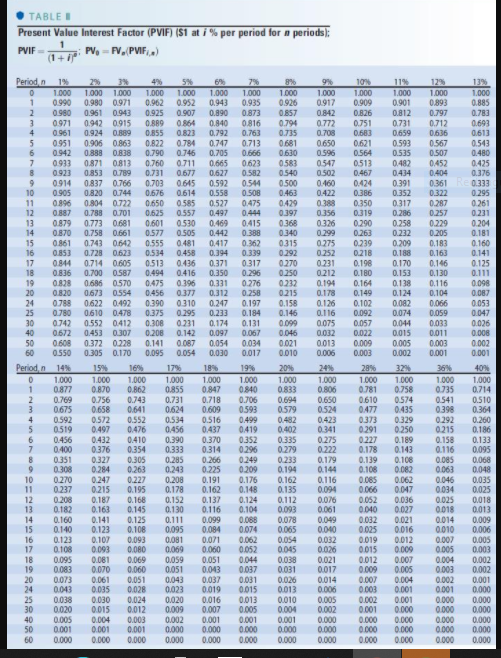

Question: TABLE Present Value Interest Factor (PVIF) (51 at i % per period for a periods): PVIF PV, PV, PVIF. (1+ 109 1.000 0.909 0.826 9%

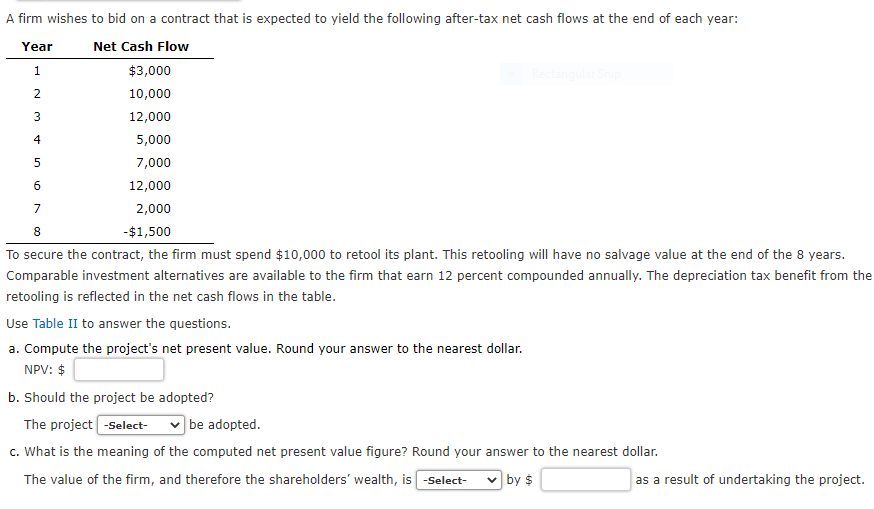

TABLE Present Value Interest Factor (PVIF) (51 at i % per period for a periods): PVIF PV, PV, PVIF. (1+ 109 1.000 0.909 0.826 9% 1.000 0917 0.842 0.772 0.708 0650 0.596 0547 0502 0.460 0.422 0.751 0.683 0.621 0.564 0.513 0.467 Period 0 1.000 1 0.990 2 0980 3 0.971 4 0.961 5 0951 6 0942 7 0933 8 0923 9 0.914 10 0.905 11 0.896 12 0.887 13 0.879 14 0.870 15 0.861 16 0.85) 17 0.844 18 0.836 19 0.828 20 0.820 24 0789 25 0.780 30 0.742 40 0672 50 0.600 60 0.550 Period, 141 D 1.000 1 0.877 2 0.769 3 4 0.592 5 0.519 6 0.456 7 0.400 8 0.351 9 0.308 10 0.270 11 0.237 12 0.208 13 0.182 14 0.160 15 0.140 16 17 0.108 18 0.095 19 0.083 20 0.073 24 0.043 25 0.038 30 0.020 40 0.005 50 0.001 60 0.000 2% 4 5% 6% 1.000 1.000 1.000 1.000 1.000 1.000 0.980 0971 0.962 0.952 0.943 0.935 0.961 0943 0.925 0.907 0.890 0.873 0.942 0915 0.889 0864 0.840 0.816 0.924 0.889 0.855 0.821 0.792 0.763 0.906 0.863 0.822 0.784 0.747 0.713 0.888 0.838 0.790 0.746 0.705 0.666 0.871 0.813 0.760 0.711 0.665 0.623 0.853 0.789 0.731 0677 0.627 0.582 0.837 0.766 0.703 0645 0.592 0.544 0.820 0.744 0.676 0.614 0.558 0.508 0.804 0.722 0.650 0585 0.527 0.475 0.788 0.701 0.625 0.557 0.497 0.444 0.773 0.681 0.601 0530 0.469 0.415 0.758 0.661 0.577 0.505 0.442 0.388 0.743 0642 0.555 0.481 0.417 0.362 0.728 0.623 0.534 0.458 0.394 0.339 0.714 0.605 0.513 0.436 0.371 0317 0.700 0.587 0.494 0.416 0.350 0.296 0.686 0570 0475 0.396 0.331 0.276 0.673 0.554 0.456 0377 0.312 0.258 0.622 0.492 0.390 0310 0.247 0.197 0.610 0.478 0.375 0.295 0.233 0.184 0.552 0.412 0.308 0231 0.174 0.131 0.453 0307 0.208 0.142 0.097 0.067 0.372 0.228 0.141 0.087 0.054 0.034 0.305 0.170 0.095 0.054 0.030 0.017 15% 169 179 189 1993 1.000 1.000 1.000 1.000 1.000 0.870 0.862 0.855 0.847 0.840 0.756 0.743 0.731 0.718 0.706 0.658 0.641 0.624 0.609 0.593 0.572 0.552 0.534 0.516 0.499 0.497 0.476 0.456 0.437 0419 0.432 0.410 0.390 0.370 0.352 0376 0.354 0.333 0.314 0.296 0.327 0.305 0.285 0.266 0.249 0.284 0.263 0.243 0.225 0.209 0.247 0.227 0.208 0.191 0.176 0.215 0.195 0.178 0.162 0.148 0.187 0.168 0.152 0.137 0.124 0.163 0.145 0.130 0.116 0.104 0.141 0.125 0.111 0.099 0.088 0.123 0.108 0.095 0.084 0.074 0.107 0.081 0.071 0.062 0.093 0.080 0.069 0.060 0.052 0.081 0.069 0.059 0.051 0.044 0.070 0.060 0.051 0,043 0.037 0.061 0.051 0.037 0.031 0.035 0.028 0.023 0.019 0.015 0.030 0.024 0.020 0.016 0.013 0.015 0.012 0.009 0.007 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 1.000 0.926 0.857 0.794 0.735 0681 0.630 0583 0.540 0.500 0.463 0429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.158 0.146 0.099 0.046 0.021 0.010 204 1.000 0.833 0.694 0579 0.482 0.402 0.335 0.279 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 0.356 0326 0.299 0.275 0.252 0.231 0212 0.194 0.178 0.126 0.116 0.075 0.032 0.013 0.006 24% 1.000 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.102 0.092 0.057 0.022 0.009 0.003 28% 1.000 0.781 0.610 0.477 0.373 0.291 0.227 0.178 0.139 0.108 0.085 0.066 0.052 0.040 13% 1.000 1.000 0.893 0.885 0797 0.783 0.712 0.693 0.6.36 0.613 0.567 0543 0.507 0.480 0,452 0.425 0.404 0.376 0.361 0.333 0.322 0.295 0.287 0.261 0.257 0.231 0.229 0.204 0.205 0.181 0.183 0.160 0.163 0.141 0.146 0.125 0.130 0.111 0.116 0.098 0.104 0.087 0.066 0.053 0.059 0.047 0.033 0.026 0.011 0.008 0.003 0.002 0.001 0.001 40% 1.000 1.000 0.735 0.714 0.541 0.510 0398 0.364 0.292 0.260 0215 0.186 0.158 0.133 0.116 0.095 0.085 0.068 0.063 0.048 0.046 0.035 0.034 0.025 0.025 0.018 0.018 0.013 0.014 0.009 0.010 0.006 0.007 0.005 0.005 0.003 0.004 0.002 0.003 0.002 0.002 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.806 0.675 1.000 0.758 0.574 0.435 0.329 0.250 0.189 0.143 0.233 0.100 0.650 0524 0.423 0.341 0.275 0.222 0.179 0.144 0.116 0.094 0.076 0.061 0.049 0.000 0.032 0.026 0.021 0.017 0.014 0.006 0.005 0.002 0.000 0.000 0.000 0.123 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 0.093 0.082 0.062 0.047 0.036 0.027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 0.025 0.019 0.015 0.012 0.009 0.007 0.003 0.002 0.001 0.000 0.000 0.043 1 2 3 4 5 8 A firm wishes to bid on a contract that is expected to yield the following after-tax net cash flows at the end of each year: Year Net Cash Flow $3,000 10,000 12,000 5,000 7,000 6 12,000 7 2,000 -$1,500 To secure the contract, the firm must spend $10,000 to retool its plant. This retooling will have no salvage value at the end of the 8 years. Comparable investment alternatives are available to the firm that earn 12 percent compounded annually. The depreciation tax benefit from the retooling is reflected in the net cash flows in the table. Use Table II to answer the questions. a. Compute the project's net present value. Round your answer to the nearest dollar. NPV: $ b. Should the project be adopted? The project -Select- be adopted. C. What is the meaning of the computed net present value figure? Round your answer to the nearest dollar. The value of the firm, and therefore the shareholders' wealth, is -Select- by $ as a result of undertaking the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts