Question: table tables question 3. Please Kindly swiect the Truel False expressions for the followiny choices: (15 pis.) 1. Tax shicld has a positive inyact on

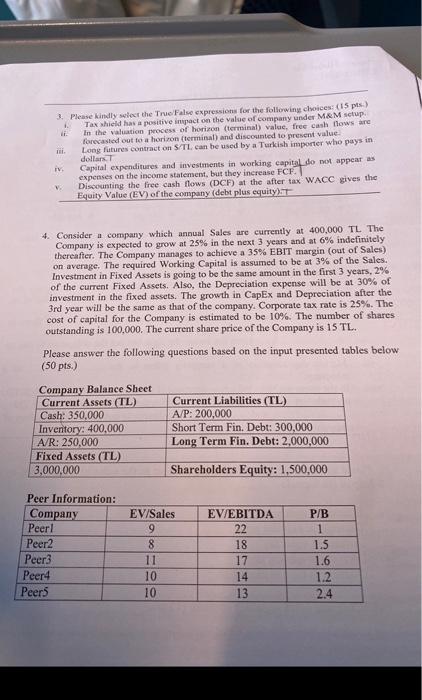

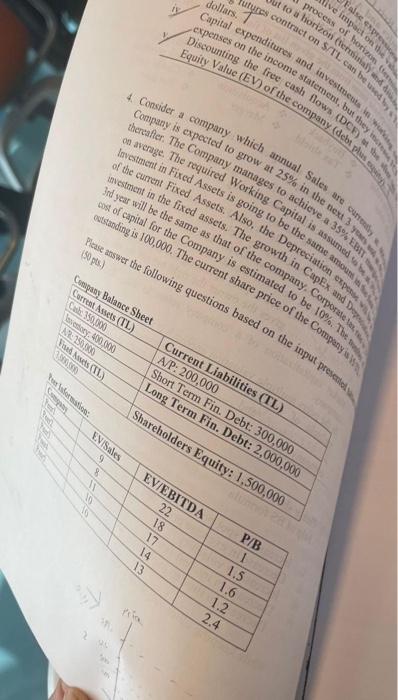

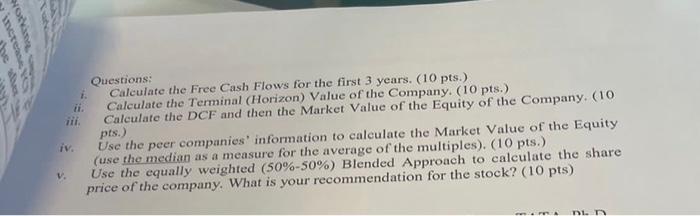

3. Please Kindly swiect the Truel False expressions for the followiny choices: (15 pis.) 1. Tax shicld has a positive inyact on the value of company under MeM setup. i. In the valuation peocess of horizon (terminal) value, free cash thows are iii. Lorevasted oot to a horizon (terminal) and discosinted to present value- iv. Collars. expenses on the income statement, but they increase FCF. Disoounting the free cash flows (DCF) at the after tax. WACC gives the Equity Value (EV) of the eompany (debt plus equity) it 4. Consider a company which annual Sales are eurrently at 400,000 Th The Company is expected to grow at 25% in the next 3 years and at 6% indefinitely thereafter. The Company manages to achicve a 35% EBIT margin (out of Sales) on average. The required Working. Capital is assumed to be at 3% of the Sales. Investment in Fixed Assets is going to be the same amount in the first 3 years, 2% of the current Fixed Assets. Also, the Depreciation expense will be at 30% of investment in the fixed assets. The growth in CapEx and Depreciation after the 3 rd year will be the same as that of the company. Corporate tax rate is 25%. The cost of capital for the Company is estimated to be 10%. The number of shares outstanding is 100,000 . The current share price of the Company is 15 TL. Please answer the following questions based on the input presented tables below (50 pts.) Questions: i. Calculate the Free Cash Flows for the first 3 years. (10 pts.) ii. Calculate the Terminal (Horizon) Value of the Company. (10 pts.) iii. Calculate the DCF and then the Market Value of the Equity of the Company. (10 iv. Us.) the peer companies' information to calculate the Market Value of the Equity (use the median as a measure for the average of the multiples). ( 10 pts.) v. Use the equally weighted (50%50%) Blended Approach to calculate the share price of the company. What is your recommendation for the stock? (10 pts) 3. Please Kindly swiect the Truel False expressions for the followiny choices: (15 pis.) 1. Tax shicld has a positive inyact on the value of company under MeM setup. i. In the valuation peocess of horizon (terminal) value, free cash thows are iii. Lorevasted oot to a horizon (terminal) and discosinted to present value- iv. Collars. expenses on the income statement, but they increase FCF. Disoounting the free cash flows (DCF) at the after tax. WACC gives the Equity Value (EV) of the eompany (debt plus equity) it 4. Consider a company which annual Sales are eurrently at 400,000 Th The Company is expected to grow at 25% in the next 3 years and at 6% indefinitely thereafter. The Company manages to achicve a 35% EBIT margin (out of Sales) on average. The required Working. Capital is assumed to be at 3% of the Sales. Investment in Fixed Assets is going to be the same amount in the first 3 years, 2% of the current Fixed Assets. Also, the Depreciation expense will be at 30% of investment in the fixed assets. The growth in CapEx and Depreciation after the 3 rd year will be the same as that of the company. Corporate tax rate is 25%. The cost of capital for the Company is estimated to be 10%. The number of shares outstanding is 100,000 . The current share price of the Company is 15 TL. Please answer the following questions based on the input presented tables below (50 pts.) Questions: i. Calculate the Free Cash Flows for the first 3 years. (10 pts.) ii. Calculate the Terminal (Horizon) Value of the Company. (10 pts.) iii. Calculate the DCF and then the Market Value of the Equity of the Company. (10 iv. Us.) the peer companies' information to calculate the Market Value of the Equity (use the median as a measure for the average of the multiples). ( 10 pts.) v. Use the equally weighted (50%50%) Blended Approach to calculate the share price of the company. What is your recommendation for the stock? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts