Question: Tables go to number 60. table goes up to 60 M IM $% Conditional Format Cal Formatting Tablety 16 x x A B G H

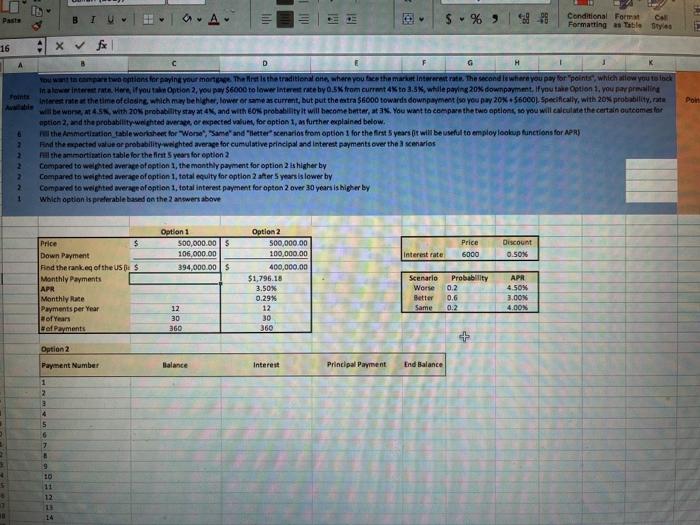

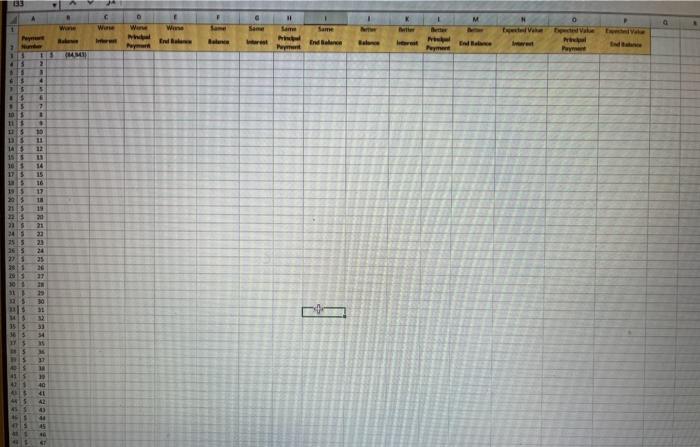

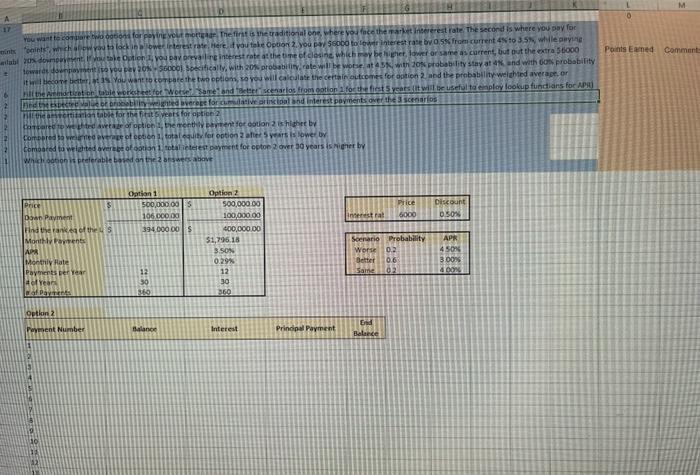

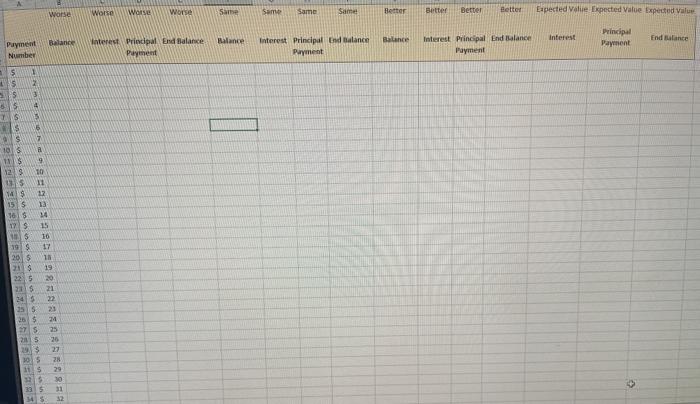

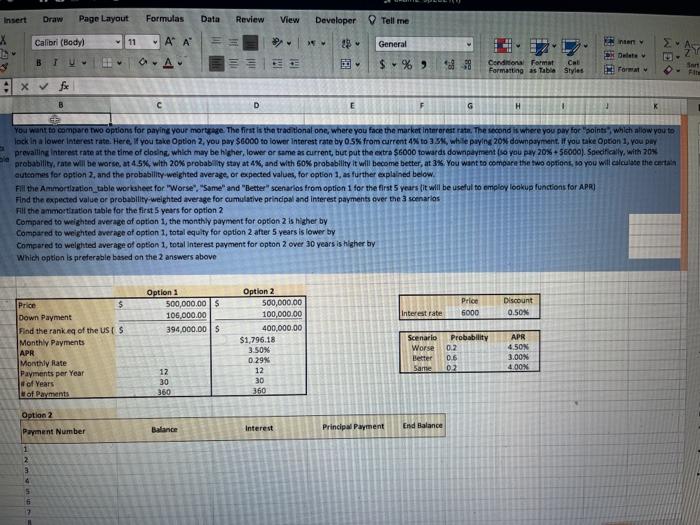

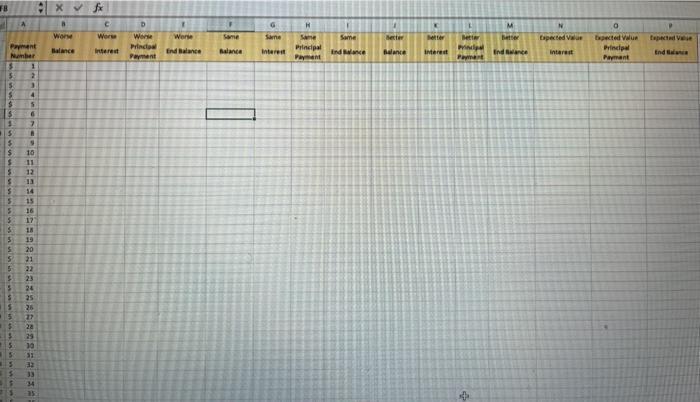

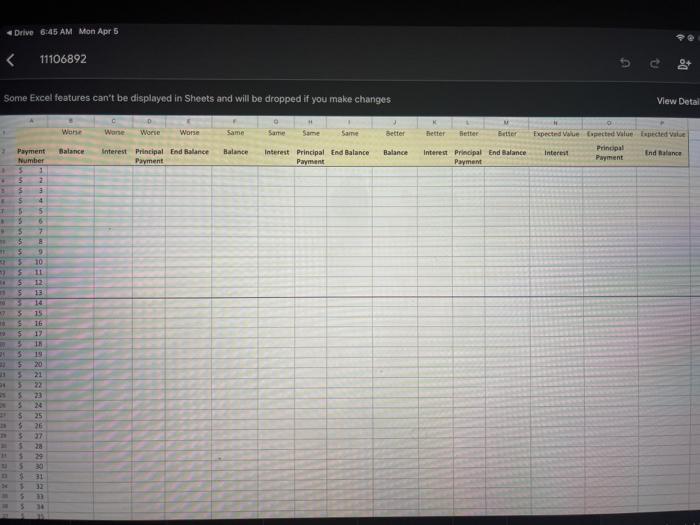

M IM $% Conditional Format Cal Formatting Tablety 16 x x A B G H Point Por 6 2 2 2 2 2 1 You want to compare two options for saying your mange. There is the traditional one, where you face the market interest rate. The second is where you pay for "points, which allow you to lock Inalow internet. Here, if you an Option 2. you pay $6000 to lower interest rate by 0.5% from current 4% to 3.5%, while paying 20% downpayment. If you the option 1. you paralline Interest rate the time of closing which may be higher lower or cames current, but put the extra $6000 towards downpayment so you pwy 20x600 Specifically, with 20% probability rate will be worse, 4.5, with 20% probability stay at 4x and with Eos probability it will become better, *t 3. You want to compare the two options to you will calculate the certain outcomes to aption and the probability we hted averat, or expected values, for option 1, as further explained below. the Ammortization table worksheet for Worse, "Same and letter scenarios trom option 1 for the first years it will be useful to employ lookup functions for APR) Find the nected value or probability weighted average for cumulative principal and interest payments over the scenarios all the ammortization table for the first years for option 2 compared to welted average of option 1, the monthly payment for option 2 is higher by Compared to weighted average of option 1, total equity for option 2 after 5 years is lower by Compared to weighted average of option 1. total interest payment for opton 2 over 30 years is higher by Which option is preferable based on the 2 answers above Price Option 1 500,000.00 $ 106,000.00 394,000.00 $ Discount 0.SOK Interest rate 5000 Price $ Down Payment Find the rankeg of the US : $ Monthly Payments APR Monthly Rate Payments per Year of Years af Payments Option 2 500,000.00 100,000.00 400,000.00 $1,796.18 3.50N 0.29% 12 30 360 Scenario Worse Probability 0.2 0.6 0.2 APR 4.50% 3.00N 4.00N Better Same 12 30 360 Option 2 Payment Number Balance Interest Principal Payment End Balance 1 2 2 5 16 7 9 12 EET 3 1 I! 1 M D Were Ware Wone Val 2 14 1 2 4 10 . ST 12 DE 14 15 101 125 PE ST ST 91 SIS 5 51 DE 1 tt ES 17 18 215 E E DE GE DE 16 36 54 PE OF 42 0 5 0 17 Points Earned Comment You want te comparation for peyne you more. The first is the traditional one, where you face the market interest rate. The second is where you pay for noints whow you to lower interest rate. Here you take por 2. you pay 560bo to interest rate by ass from current 4 to 3.5 while we establimentale in you are interest rate at the time of doing which may be higher low or same as current, but out the extra 5600 towards do you 20% Sooloecifically, with 20% probability rate will be wote with probability stay at and with a probability it welcome bett You want to compare the two option, you will calculate the certain outcomes for option and the probability welchted average or the identitet for Womes and descenarios tromotion for the years will be usefultatemploy lookup functions for AP and lifted hver formative arcand interest payments over the 3 scenarios Haritettiintable for the rivers for option Teord Avea of options, the month for coton ishlaby pred so we of een totality for option after 5 years is lower by omorowited average of ootantotalitetest payment for optop over 30 years is by Whedon pelerable based on 2 wees above Option1 500,000.00 106.000.00 394.000 DOS Option 2 500,000.00 100,000.00 Price 6000 Discount DSON esta 400,000.00 $1,795 16 Price $ Down Payment Hnd tre rankenthes Monthletes JAPA Monthly Hate Porter Year of Pan 3. SON Scenario Probability Worse 02 Better 0.6 Same 02 APR 450 300 doo 0.29% 12 30 260 360 Optkm 2 Payment Number Bilance Interest Principal Payment End Belance Worse Worse Warse Word Same Same Same Same Better Better Bettel Better Expected Valie Expected Value Expected value Principal Balance Balance Balance Interest Endilance Interest Predial End Balance Payment Puyment Number Interest Principal End Balance Payment Interest Principal End Balance Payment Payment 1 2 3 s 5 TS 4 5 7 S 1013 129 TO 11 115 19 15 1615 12 WS 19S 12 13 14 15 10 17 13 19 20 S $ 22 5 345 22 255 25$ 7 S 25 2015 93 27 5 115 29 PS 335 12 RANDERS > Insert Draw Page Layout Formulas Data Review View Developer Tell me Calibri (Body) 11 - A A General DR Dete BTU a. III WI $ %) Conditional Format CRE Formatting as Table Styles Format Sant Fit xfx D E H 1 1 You want to compare two options for paying your mortgage. The first is the traditional one, where you face the market Interest rate. The second is where you pay for points, which allow you to lock in a lower Interest rate. Here, you take Option 2. you pay $6000 to lower Interest rate by 0.5% from current 4% to 35%, while paying 20% downpayment. If you take Option 1, you DAY prevailing Interest rate at the time of closing, which may be higher, lower er same as current, but put the extra $GOOO towards downpayment so you pay 20% +56000). Sedfically, with 20% probability rate will be worse, at 4.5%, with 20% probability stay at 4%, and with 50% probability it will become better, at 3%. You want to compare the two options, so you will call to the certain outcomes for option 2, and the probability weighted average, or expected values, for option 1. as further explained below. Fill the Ammortization_table woricsheet for "Worse", "Some" and "Better" scenarios from option for the first 5 years it will be useful to employ lookup functions for APRI Find the expected value or probability-weighted average for cumulative principal and interest payments over the 3 scenarios Fill the ammortiration table for the first 5 years for option 2 Compared to weighted average of option 1, the monthly payment for option 2 is higher by Compared to weighted average of option 1, total equity for option 2 after 5 years is lower by Compared to weighted average of option 1, total interest payment for opton 2 over 30 years is higher by Which option is preferable based on the 2 answers above Option 1 500,000.00 $ 106,000.00 394,000.00 Price 6000 Discount 0.50 Interest rate Price $ Down Payment Find the rank of the USS Monthly Payments APR Monthly Rate Payments per Year of Years of Payments Option 2 500,000.00 100,000.00 400.000,00 $1,796.18 3.50% 0.29% 12 30 360 Scenario Worse Better Same Probability 0.2 0.6 02 APR 4.50N 3.00 400% 12 30 360 Option 2 Balance interesa Interest Principal Payment Payment Number End Balance 1 2 3 x x B 9 N 1 M N 0 Wor Were D Wom Prindo Ware Same Espected tapete Balance Payment Number 1 Same Placa Ende Pay interest Balanta End Balance Balance interest Indence pecte Value Principe Pamant interest End 3 4 5 $ $ 3 3 9 7 $ $ $ $ 16 5 12 $ 13 5 14 5 15 5 16 5 17 5 IN 19 5 20 5 21 5 23 5 26 5 25 526 AAARRRR 5 33 34 25 + Drive 6:45 AM Mon Apr 5 22 11106892 Some Excel features can't be displayed in Sheets and will be dropped if you make changes View Detail Wone Wane Worse Worse Same Same Same Same Better Better Better Better Expected le pected Value Expected value Principal Interest Payment End Balance Balance Interest Principal End Balance Balance Balance Payment Interest Principal End Balance Payment Interest Principal End Balance Payment Payment Number 5 1 5 2 5 3 $ 4 $ 5 6 $ 7 $ 5 9 5 10 $ 5 12 5 13 14 5 15 16 $ 12 5 18 5 19 $ 20 3 21 5 22 5 24 5 25 5 26 5 $ 28 29 31 32 3 5 5 M IM $% Conditional Format Cal Formatting Tablety 16 x x A B G H Point Por 6 2 2 2 2 2 1 You want to compare two options for saying your mange. There is the traditional one, where you face the market interest rate. The second is where you pay for "points, which allow you to lock Inalow internet. Here, if you an Option 2. you pay $6000 to lower interest rate by 0.5% from current 4% to 3.5%, while paying 20% downpayment. If you the option 1. you paralline Interest rate the time of closing which may be higher lower or cames current, but put the extra $6000 towards downpayment so you pwy 20x600 Specifically, with 20% probability rate will be worse, 4.5, with 20% probability stay at 4x and with Eos probability it will become better, *t 3. You want to compare the two options to you will calculate the certain outcomes to aption and the probability we hted averat, or expected values, for option 1, as further explained below. the Ammortization table worksheet for Worse, "Same and letter scenarios trom option 1 for the first years it will be useful to employ lookup functions for APR) Find the nected value or probability weighted average for cumulative principal and interest payments over the scenarios all the ammortization table for the first years for option 2 compared to welted average of option 1, the monthly payment for option 2 is higher by Compared to weighted average of option 1, total equity for option 2 after 5 years is lower by Compared to weighted average of option 1. total interest payment for opton 2 over 30 years is higher by Which option is preferable based on the 2 answers above Price Option 1 500,000.00 $ 106,000.00 394,000.00 $ Discount 0.SOK Interest rate 5000 Price $ Down Payment Find the rankeg of the US : $ Monthly Payments APR Monthly Rate Payments per Year of Years af Payments Option 2 500,000.00 100,000.00 400,000.00 $1,796.18 3.50N 0.29% 12 30 360 Scenario Worse Probability 0.2 0.6 0.2 APR 4.50% 3.00N 4.00N Better Same 12 30 360 Option 2 Payment Number Balance Interest Principal Payment End Balance 1 2 2 5 16 7 9 12 EET 3 1 I! 1 M D Were Ware Wone Val 2 14 1 2 4 10 . ST 12 DE 14 15 101 125 PE ST ST 91 SIS 5 51 DE 1 tt ES 17 18 215 E E DE GE DE 16 36 54 PE OF 42 0 5 0 17 Points Earned Comment You want te comparation for peyne you more. The first is the traditional one, where you face the market interest rate. The second is where you pay for noints whow you to lower interest rate. Here you take por 2. you pay 560bo to interest rate by ass from current 4 to 3.5 while we establimentale in you are interest rate at the time of doing which may be higher low or same as current, but out the extra 5600 towards do you 20% Sooloecifically, with 20% probability rate will be wote with probability stay at and with a probability it welcome bett You want to compare the two option, you will calculate the certain outcomes for option and the probability welchted average or the identitet for Womes and descenarios tromotion for the years will be usefultatemploy lookup functions for AP and lifted hver formative arcand interest payments over the 3 scenarios Haritettiintable for the rivers for option Teord Avea of options, the month for coton ishlaby pred so we of een totality for option after 5 years is lower by omorowited average of ootantotalitetest payment for optop over 30 years is by Whedon pelerable based on 2 wees above Option1 500,000.00 106.000.00 394.000 DOS Option 2 500,000.00 100,000.00 Price 6000 Discount DSON esta 400,000.00 $1,795 16 Price $ Down Payment Hnd tre rankenthes Monthletes JAPA Monthly Hate Porter Year of Pan 3. SON Scenario Probability Worse 02 Better 0.6 Same 02 APR 450 300 doo 0.29% 12 30 260 360 Optkm 2 Payment Number Bilance Interest Principal Payment End Belance Worse Worse Warse Word Same Same Same Same Better Better Bettel Better Expected Valie Expected Value Expected value Principal Balance Balance Balance Interest Endilance Interest Predial End Balance Payment Puyment Number Interest Principal End Balance Payment Interest Principal End Balance Payment Payment 1 2 3 s 5 TS 4 5 7 S 1013 129 TO 11 115 19 15 1615 12 WS 19S 12 13 14 15 10 17 13 19 20 S $ 22 5 345 22 255 25$ 7 S 25 2015 93 27 5 115 29 PS 335 12 RANDERS > Insert Draw Page Layout Formulas Data Review View Developer Tell me Calibri (Body) 11 - A A General DR Dete BTU a. III WI $ %) Conditional Format CRE Formatting as Table Styles Format Sant Fit xfx D E H 1 1 You want to compare two options for paying your mortgage. The first is the traditional one, where you face the market Interest rate. The second is where you pay for points, which allow you to lock in a lower Interest rate. Here, you take Option 2. you pay $6000 to lower Interest rate by 0.5% from current 4% to 35%, while paying 20% downpayment. If you take Option 1, you DAY prevailing Interest rate at the time of closing, which may be higher, lower er same as current, but put the extra $GOOO towards downpayment so you pay 20% +56000). Sedfically, with 20% probability rate will be worse, at 4.5%, with 20% probability stay at 4%, and with 50% probability it will become better, at 3%. You want to compare the two options, so you will call to the certain outcomes for option 2, and the probability weighted average, or expected values, for option 1. as further explained below. Fill the Ammortization_table woricsheet for "Worse", "Some" and "Better" scenarios from option for the first 5 years it will be useful to employ lookup functions for APRI Find the expected value or probability-weighted average for cumulative principal and interest payments over the 3 scenarios Fill the ammortiration table for the first 5 years for option 2 Compared to weighted average of option 1, the monthly payment for option 2 is higher by Compared to weighted average of option 1, total equity for option 2 after 5 years is lower by Compared to weighted average of option 1, total interest payment for opton 2 over 30 years is higher by Which option is preferable based on the 2 answers above Option 1 500,000.00 $ 106,000.00 394,000.00 Price 6000 Discount 0.50 Interest rate Price $ Down Payment Find the rank of the USS Monthly Payments APR Monthly Rate Payments per Year of Years of Payments Option 2 500,000.00 100,000.00 400.000,00 $1,796.18 3.50% 0.29% 12 30 360 Scenario Worse Better Same Probability 0.2 0.6 02 APR 4.50N 3.00 400% 12 30 360 Option 2 Balance interesa Interest Principal Payment Payment Number End Balance 1 2 3 x x B 9 N 1 M N 0 Wor Were D Wom Prindo Ware Same Espected tapete Balance Payment Number 1 Same Placa Ende Pay interest Balanta End Balance Balance interest Indence pecte Value Principe Pamant interest End 3 4 5 $ $ 3 3 9 7 $ $ $ $ 16 5 12 $ 13 5 14 5 15 5 16 5 17 5 IN 19 5 20 5 21 5 23 5 26 5 25 526 AAARRRR 5 33 34 25 + Drive 6:45 AM Mon Apr 5 22 11106892 Some Excel features can't be displayed in Sheets and will be dropped if you make changes View Detail Wone Wane Worse Worse Same Same Same Same Better Better Better Better Expected le pected Value Expected value Principal Interest Payment End Balance Balance Interest Principal End Balance Balance Balance Payment Interest Principal End Balance Payment Interest Principal End Balance Payment Payment Number 5 1 5 2 5 3 $ 4 $ 5 6 $ 7 $ 5 9 5 10 $ 5 12 5 13 14 5 15 16 $ 12 5 18 5 19 $ 20 3 21 5 22 5 24 5 25 5 26 5 $ 28 29 31 32 3 5 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts