Question: Take a horizontal approach to set up a Markowitz optimization model with the objective and the constraints based on a universe of 40 Canadian financial

Take a horizontal approach to set up a Markowitz optimization model with the objective and the constraints based on a universe of 40 Canadian financial stocks. Short selling is allowed. Show your equations then discuss the meaning of each of your constraints.

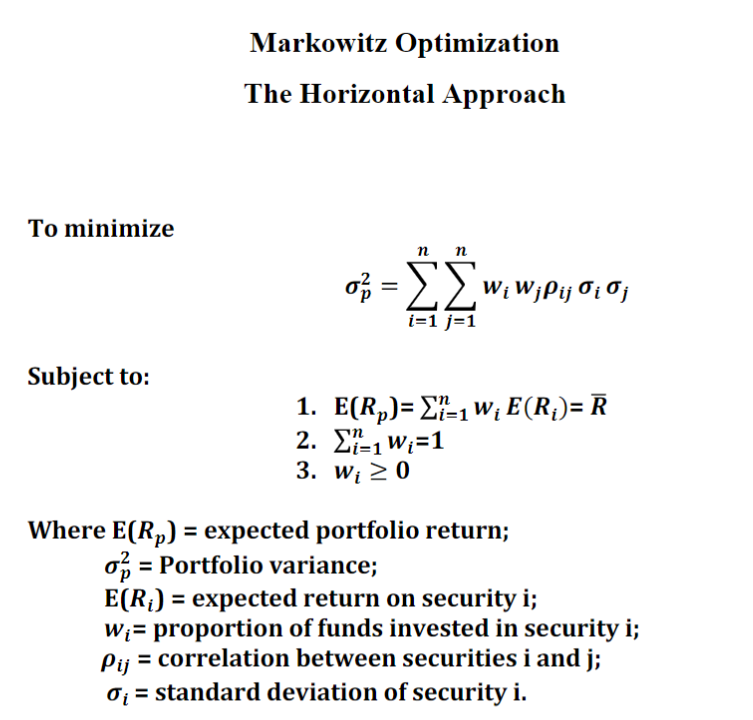

Markowitz Optimization The Horizontal Approach To minimize = ww, , i=1 j=1 Subject to: n 1. E(Rp)= X7-1 W; E(R;)= 2. X1-1 W;=1 3. Wi 20 = Where E(Rp) = expected portfolio return; op = Portfolio variance; E(Ri) = expected return on security i; Wi= proportion of funds invested in security i; Pij = correlation between securities i and j; Oi = = standard deviation of security i. Markowitz Optimization The Horizontal Approach To minimize = ww, , i=1 j=1 Subject to: n 1. E(Rp)= X7-1 W; E(R;)= 2. X1-1 W;=1 3. Wi 20 = Where E(Rp) = expected portfolio return; op = Portfolio variance; E(Ri) = expected return on security i; Wi= proportion of funds invested in security i; Pij = correlation between securities i and j; Oi = = standard deviation of security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts