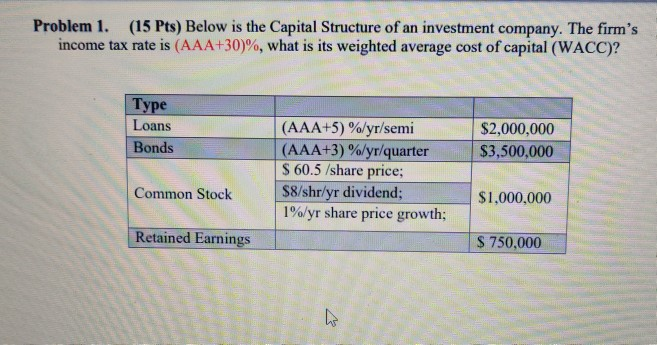

Question: Take AAA=0 Problem 1. (15 Pts) Below is the Capital Structure of an investment company. The firm's income tax rate is (AAA+30)%, what is its

Take AAA=0

Problem 1. (15 Pts) Below is the Capital Structure of an investment company. The firm's income tax rate is (AAA+30)%, what is its weighted average cost of capital (WACC)? Type Loans Bonds $2,000,000 $3,500,000 (AAA+5) %/yr/semi (AAA+3) %/yr/quarter $ 60.5 /share price; $8/shr/yr dividend; 1%/yr share price growth; | Common Stock $1,000,000 Retained Earnings $ 750,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts