Question: Take Test: Begin Final Exam - 200 x - C : Apps A vuws.westemsydney.edu.au/webapps/assessment/take/lake.jsp?course assessment.id=114122_18course_id-35741_18content id=_6155165_18question min 1x. Q * * 0: YouTube S Week

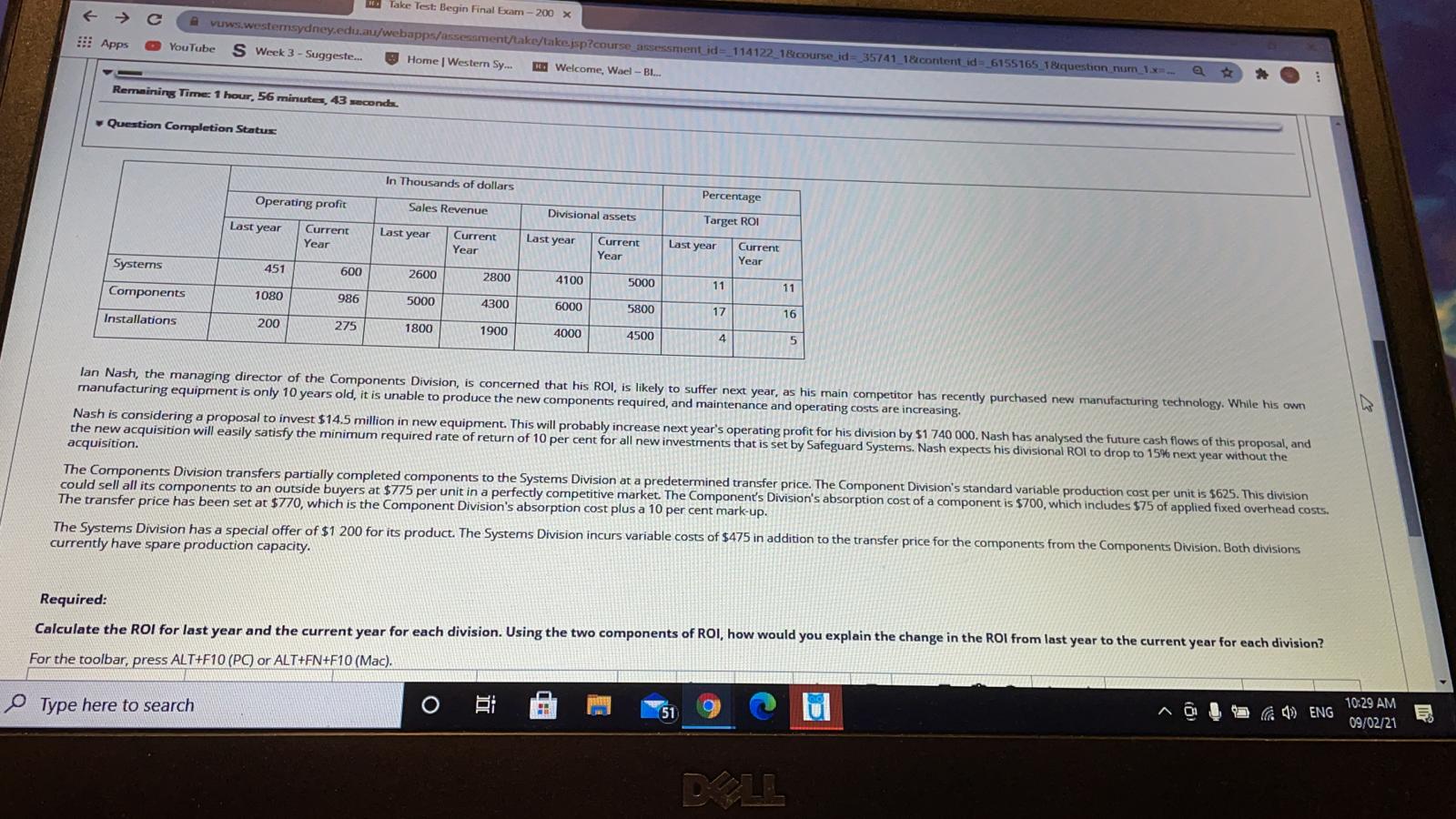

Take Test: Begin Final Exam - 200 x - C : Apps A vuws.westemsydney.edu.au/webapps/assessment/take/lake.jsp?course assessment.id=114122_18course_id-35741_18content id=_6155165_18question min 1x. Q * * 0: YouTube S Week 3 - Suggeste.. Home | Western Sy. Welcome, Wael - BI.. Remaining Time: 1 hour, 56 minutes, 43 seconds. Question Completion Status In Thousands of dollars Percentage Operating profit Sales Revenue Divisional assets Target ROI Last year Current Last year Current Last year Current Last year Current Year Year Year Year Systems 451 600 2600 2800 4100 5000 71 11 Components 1080 986 5000 4300 6000 5800 17 16 Installations 200 275 1800 1900 4000 450 lan Nash, the managing director of the Components Division, is concerned that his ROI, is likely to suffer next year, as his main competitor has recently purchased new manufacturing technology. While his own manufacturing equipment is only 10 years old, it is unable to produce the new components required, and maintenance and operating costs are increasing. Nash is considering a proposal to invest $14.5 million in new equipment. This will probably increase next year's operating profit for his division by $1 740 000. Nash has analysed the future cash flows of this proposal, and the new acquisition will easily satisfy the minimum required rate of return of 10 per cent for all new investments that is set by Safeguard Systems. Nash expects his divisional ROI to drop to 15% next year without the acquisition. The Components Division transfers partially completed components to the Systems Division at a predetermined transfer price. The Component Division's standard variable production cost per unit is $625. This division could sell all its components to an outside buyers at $775 per unit in a perfectly competitive market. The Component's Division's absorption cost of a component is $700, which includes $75 of applied fixed overhead costs. The transfer price has been set at $770, which is the Component Division's absorption cost plus a 10 per cent mark-up. The Systems Division has a special offer of $1 200 for its product. The Systems Division incurs variable costs of $475 in addition to the transfer price for the components from the Components Division. Both divisions currently have spare production capacity. Required: Calculate the ROI for last year and the current year for each division. Using the two components of ROI, how would you explain the change in the ROI from last year to the current year for each division? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). ^01 @ENG 10:29 AM Type here to search O Hi 51 9 0 09/02/21 DELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts