Question: Take the portfolio diversification model in Lecture 10 notes where the home country investment has expected return i, the foreign country has expected return 2,with

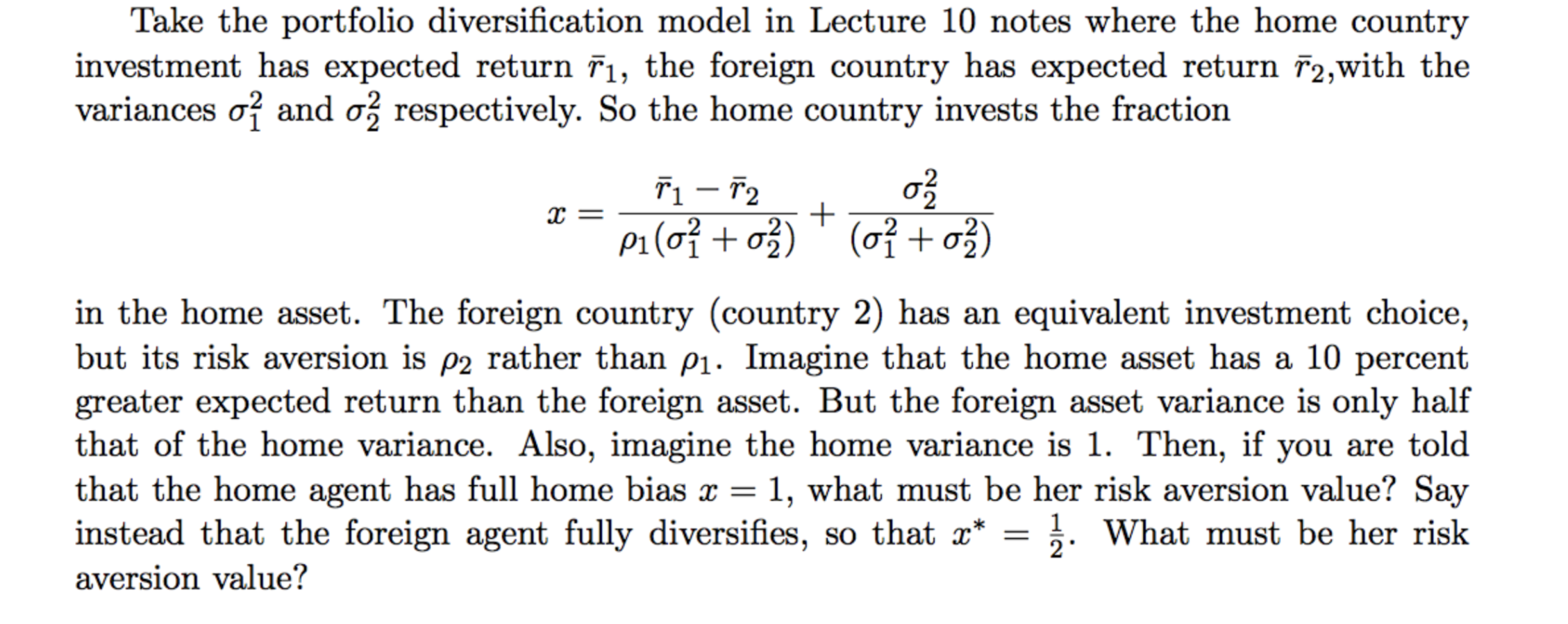

Take the portfolio diversification model in Lecture 10 notes where the home country investment has expected return i, the foreign country has expected return 2,with the variances o and o respectively. So the home country invests the fraction x= ri - 72 o piloi + oz)" (o + oz) + in the home asset. The foreign country (country 2) has an equivalent investment choice, but its risk aversion is p2 rather than P1. Imagine that the home asset has a 10 percent greater expected return than the foreign asset. But the foreign asset variance is only half that of the home variance. Also, imagine the home variance is 1. Then, if you are told that the home agent has full home bias x = 1, what must be her risk aversion value? Say instead that the foreign agent fully diversifies, so that x* 2. What must be her risk aversion value? Take the portfolio diversification model in Lecture 10 notes where the home country investment has expected return i, the foreign country has expected return 2,with the variances o and o respectively. So the home country invests the fraction x= ri - 72 o piloi + oz)" (o + oz) + in the home asset. The foreign country (country 2) has an equivalent investment choice, but its risk aversion is p2 rather than P1. Imagine that the home asset has a 10 percent greater expected return than the foreign asset. But the foreign asset variance is only half that of the home variance. Also, imagine the home variance is 1. Then, if you are told that the home agent has full home bias x = 1, what must be her risk aversion value? Say instead that the foreign agent fully diversifies, so that x* 2. What must be her risk aversion value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts