Question: taken from fm102 please immediately solution Question 2_(10 marks) At the commencement of the current financial year Rene Silverwater invested $70,000 in a 2 year

taken from fm102 please immediately solution

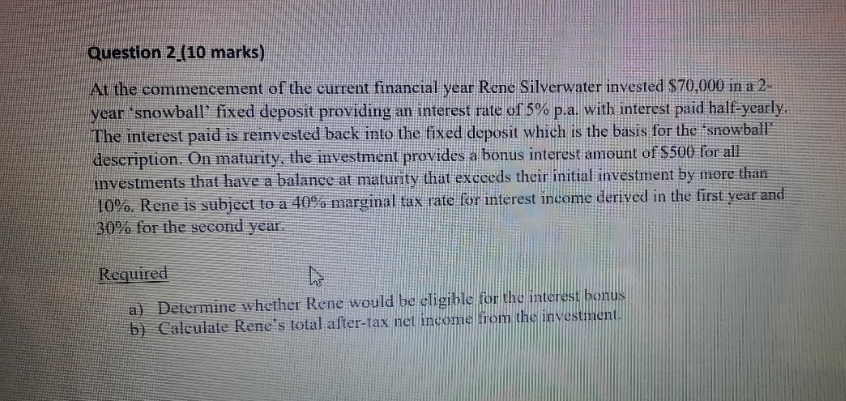

Question 2_(10 marks) At the commencement of the current financial year Rene Silverwater invested $70,000 in a 2 year *snowball' fixed deposit providing an interest rate of 5% p.a. with interest paid half-yearly. The interest paid is reinvested back into the fixed deposit which is the basis for the 'snowball" description. On maturity, the investment provides a bonus interest amount of $500 for all investments that have a balance at maturity that exceeds their initial investment by more than 10%. Rene is subject to a 40% marginal tax rate for interest income derived in the first year and 30% for the second year Required a) Determine whether Rene would be eligible for the interest bonus by Calculate Rene's total after-tax net income from the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts