Question: Taking it to the Net A19 BTN 12-3 Access the April 14, 2016, filing of the 10-K report (for year ending December 31, 2015) of

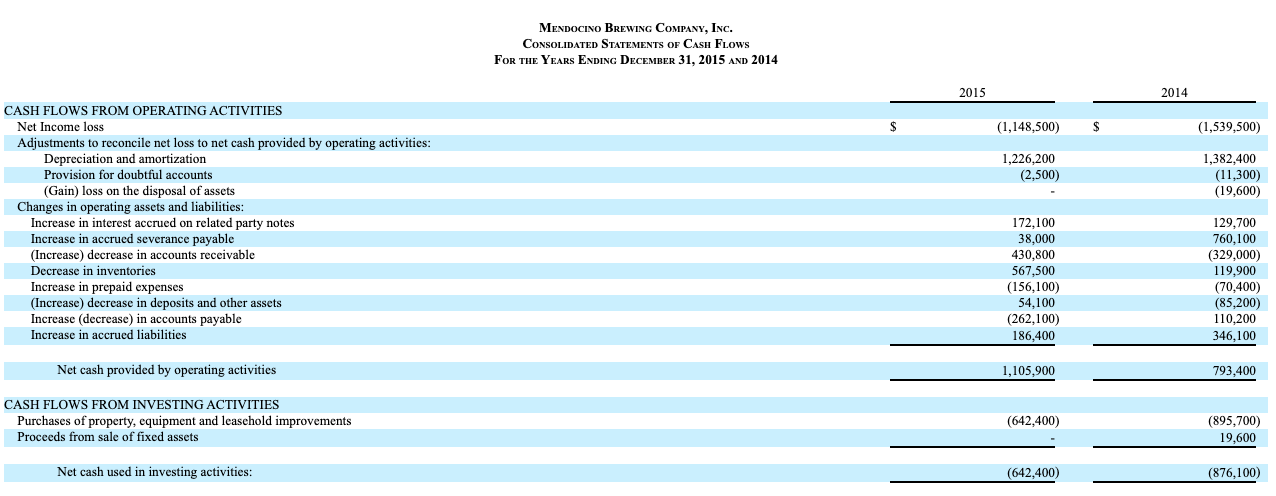

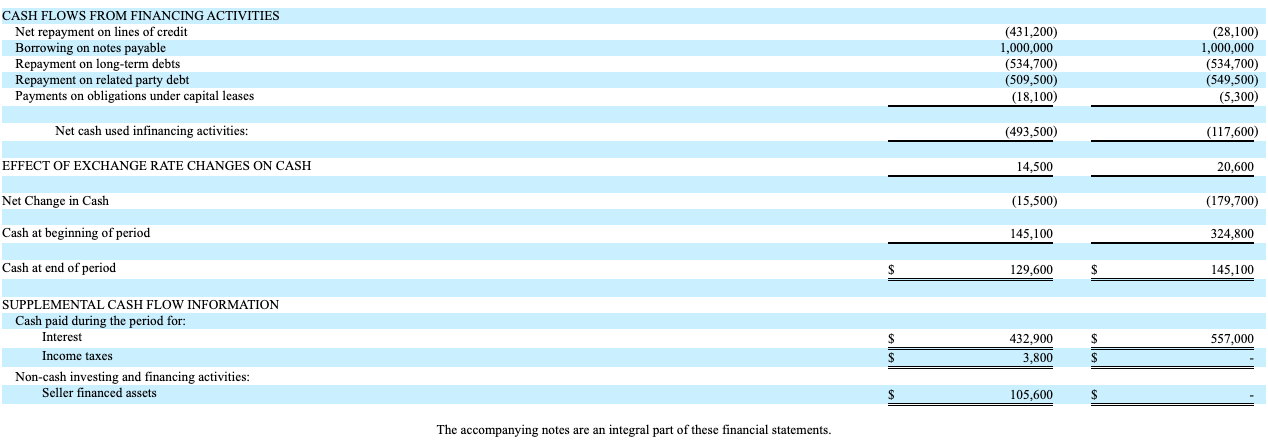

Taking it to the Net A19 BTN 12-3 Access the April 14, 2016, filing of the 10-K report (for year ending December 31, 2015) of Mendocino Brewing Company, Inc. (ticker: MENB) at SEC.gov @ Required 1. Does Mendocino Brewing use the direct or indirect method to construct its consolidated statement of cash flows? 2. For the year ended December 31, 2015, what is the largest item in reconciling the net income (or loss) to net cash provided by operating activities? 3. In the recent two years, has the company been more successful in generating operating cash flows or in generating net income? Identify the figures to support the answer. 4. In the year ended December 31, 2015, what was the largest cash outflow for investing activities and for financing activities? 5. What item(s) does the company report as supplemental cash flow information? 6. Does the company report any noncash financing activities for 2015? Identify them, if any. MENDOCINO BREWING COMPANY, Inc. CONSOLIDATED STATEMENTS OF CASH Flows FOR THE YEARS ENDING DECEMBER 31, 2015 AND 2014 2015 2014 $ (1,148,500) $ (1,539,500) 1,226,200 (2,500) 1,382,400 (11,300) (19,600) CASH FLOWS FROM OPERATING ACTIVITIES Net Income loss Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization Provision for doubtful accounts (Gain) loss on the disposal of assets Changes in operating assets and liabilities: Increase in interest accrued on related party notes Increase in accrued severance payable (Increase) decrease in accounts receivable Decrease in inventories Increase in prepaid expenses (Increase) decrease in deposits and other assets Increase (decrease) in accounts payable Increase in accrued liabilities 172.100 38,000 430,800 567,500 (156,100) 54,100 (262,100) 186,400 129,700 760,100 (329,000) 119,900 (70,400) (85,200) 110,200 346,100 Net cash provided by operating activities 1,105,900 793,400 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property, equipment and leasehold improvements Proceeds from sale of fixed assets (642,400) (895,700) 19,600 Net cash used in investing activities: (642,400) (876,100) CASH FLOWS FROM FINANCING ACTIVITIES Net repayment on lines of credit Borrowing on notes payable Repayment on long-term debts Repayment on related party debt Payments on obligations under capital leases (431,200) 1,000,000 (534.700) (509,500) (18,100) (28,100) 1,000,000 (534,700) (549,500) (5,300) Net cash used infinancing activities: (493,500) (117,600) EFFECT OF EXCHANGE RATE CHANGES ON CASH 14,500 20,600 Net Change in Cash (15,500) (179,700) Cash at beginning of period 145,100 324,800 Cash at end of period 129,600 145,100 557,000 SUPPLEMENTAL CASH FLOW INFORMATION Cash paid during the period for: Interest Income taxes Non-cash investing and financing activities: Seller financed assets 432,900 3,800 $ 105,600 $ The accompanying notes are an integral part of these financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts