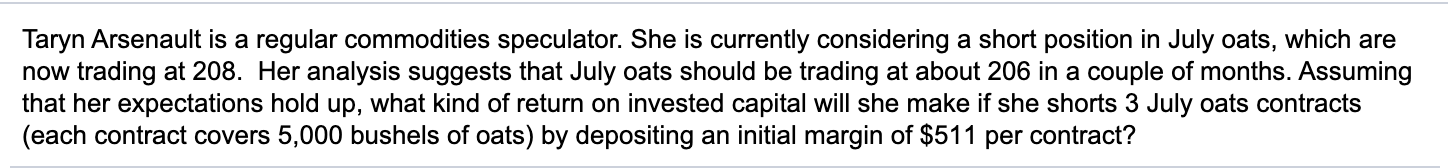

Question: Taryn Arsenault is a regular commodities speculator. She is currently considering a short position in July oats, which are now trading at 208. Her analysis

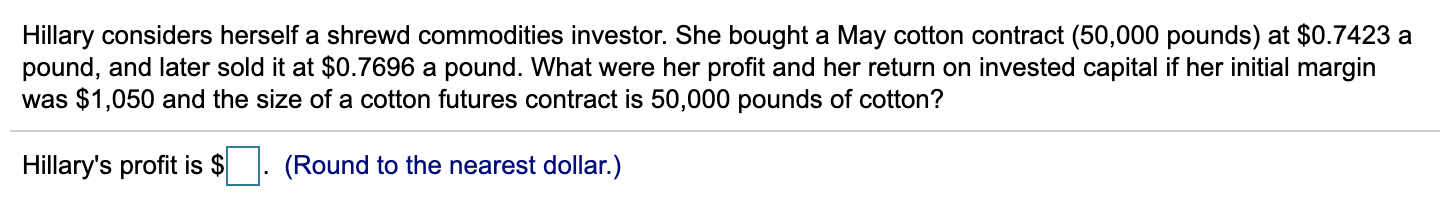

Taryn Arsenault is a regular commodities speculator. She is currently considering a short position in July oats, which are now trading at 208. Her analysis suggests that July oats should be trading at about 206 in a couple of months. Assuming that her expectations hold up, what kind of return on invested capital will she make if she shorts 3 July oats contracts (each contract covers 5,000 bushels of oats) by depositing an initial margin of $511 per contract? Hillary considers herself a shrewd commodities investor. She bought a May cotton contract (50,000 pounds) at $0.7423 a pound, and later sold it at $0.7696 a pound. What were her profit and her return on invested capital if her initial margin was $1,050 and the size of a cotton futures contract is 50,000 pounds of cotton? Hillary's profit is $ . (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts