Question: Task 1 . 2 : On September 1 2 , Olympia Construction trades a truck with the historical cost of $ 2 4 0 0

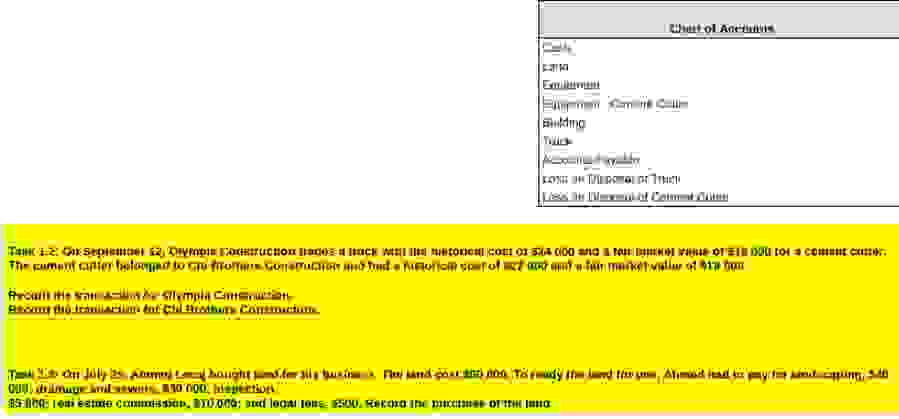

Task : On September Olympia Construction trades a truck with the historical cost of $ and a fair market value of $ for a cement cutter. The cement cutter belonged to Chi Brothers Construction and had a historical cost of $ and a fair market value of $

Record the transaction for Olympia Construction.

Record the transaction for Chi Brothers Construction. Task : On July Ahmed Lecaj bought land for his business. The land cost $ To ready the land for use, Ahmed had to pay for landscaping, $; drainage and sewers, $; inspection,

$; real estate commission, $; and legal fees, $ Record the purchase of the land. Chart of Accounts

Cash

Land

Equipment

Equipment Cement Cutter

Building

Truck

Accounts Payable

Loss on Disposal of Truck

Loss on Disposal of Cement Cutter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock