Question: Task 1: Compute the respective average, standard deviation, and covariance of monthly or daily stock returns. Covariance table will be in the form: Var(stock1, stock1)

Task 1: Compute the respective average, standard deviation, and covariance of monthly or daily stock returns.

Covariance table will be in the form:

| Var(stock1, stock1) | Cov(stock1, stock2) |

| Cov(stock1, stock2) | Var(stock2, stock2) |

Note: Use STDEV.P in Excel for the standard deviation

Task 2: Using the obtained statistics fromQ1, calculate an equal weighted portfolio return and portfolio variance for the first portfolio using the below equations:

Equal weighted portfolio return:

E(RP) = w1(avg(r1)) + w2(avg(r2));

where w is the weight of each stock in the portfolio. And avg(r1) is the mean return for stock 1 and avg(r2) is the mean return for stock 2.

Portfolio variance:

2p = w12( 2s1) + w22( 2s2) + 2*w1 w2 * s1 s2

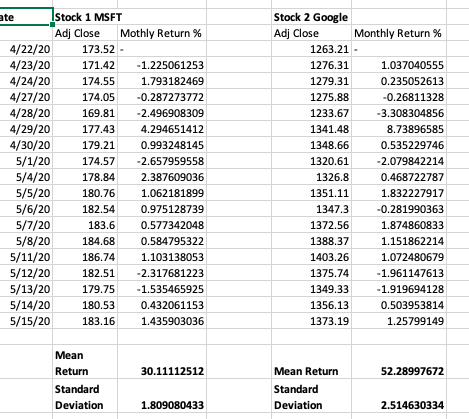

ate Stock 1 MSFT Adj Close Mothly Return% 4/22/20 173.52 - 4/23/20 171.42 -1.225061253 4/24/20 174.55 1.793182469 4/27/20 174.05 -0.287273772 4/28/20 169.81 -2.496908309 4/29/20 177.43 4.294651412 4/30/20 179.21 0.993248145 5/1/20 174.57 -2.657959558 5/4/20 178.84 2.387609036 5/5/20 180.76 1.062181899 5/6/20 182.54 0.975128739 5/7/20 183.6 0.577342048 5/8/20 184.68 0.584795322 5/11/20 186.74 1.103138053 5/12/20 182.51 -2.317681223 5/13/20 179.75 -1.535465925 5/14/20 180.53 0.432061153 5/15/20 183.16 1.435903036 Stock 2 Google Adj Close Monthly Return % 1263.21 - 1276.31 1.037040555 1279.31 0.235052613 1275.88 -0.26811328 1233.67 -3.308304856 1341.48 8.73896585 1348.66 0.535229746 1320.61 -2.079842214 1326.8 0.468722787 1351.11 1.832227917 1347.3 -0.281990363 1372.56 1.874860833 1388.37 1.151862214 1403.26 1.072480679 1375.74 -1.961147613 1349.33 -1.919694128 1356.13 0.503953814 1373.19 1.25799149 Mean Return 30.11112512 52.28997672 Standard Deviation Mean Return Standard Deviation 1.809080433 2.514630334

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts