Question: Task 1 'EdlarServices ltd. makes components for electronic equipment and has recently tendered for a contract to supply an item to a satellite navigation equipment

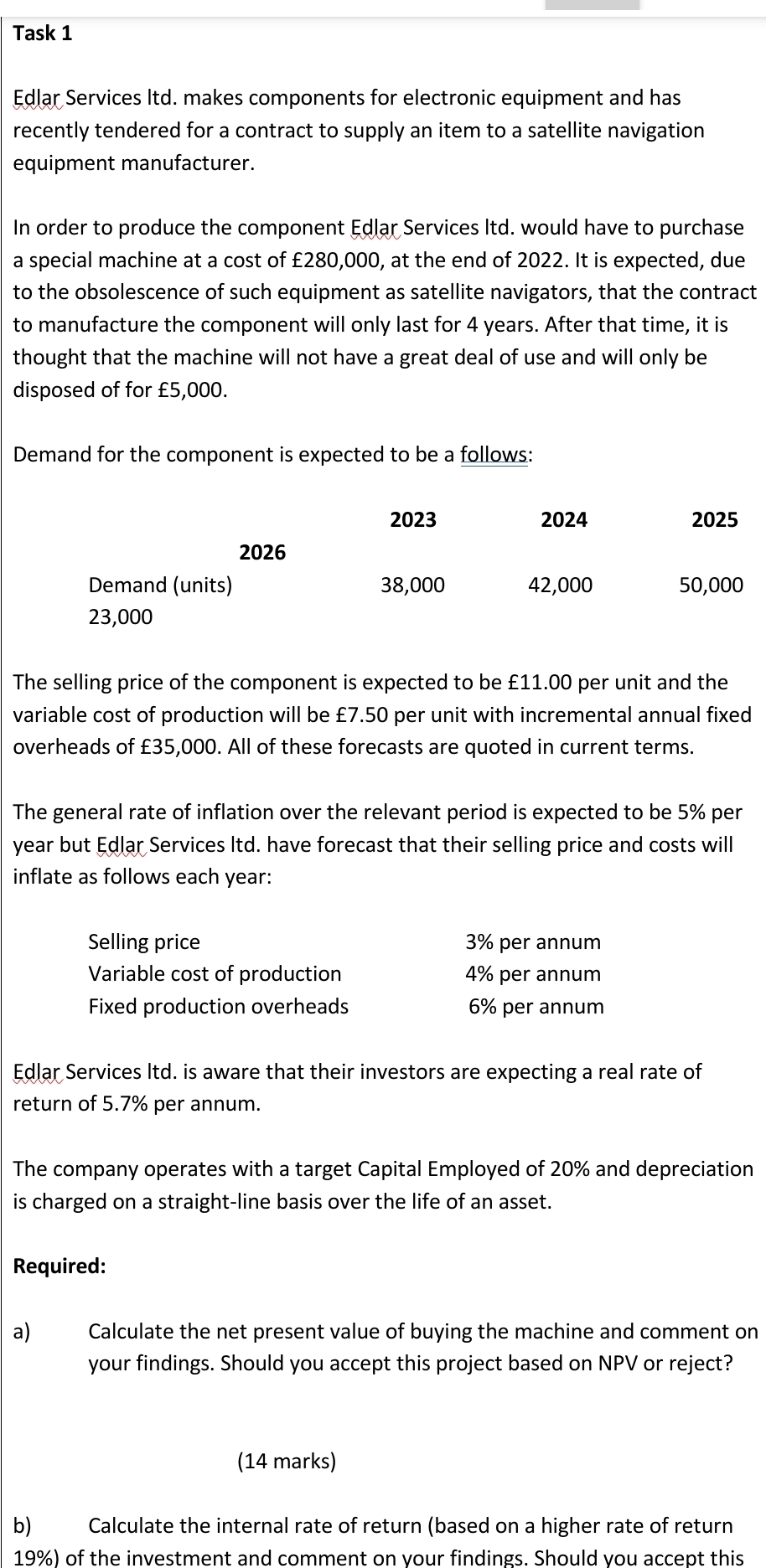

Task 1 'EdlarServices ltd. makes components for electronic equipment and has recently tendered for a contract to supply an item to a satellite navigation equipment manufacturer. In order to produce the component [Ed/lair, Services ltd. would have to purchase a special machine at a cost of 280,000, at the end of 2022. It is expected, due to the obsolescence of such equipment as satellite navigators, that the contract to manufacture the component will only last for 4 years. After that time, it is thought that the machine will not have a great deal of use and will only be disposed of for 5,000. Demand for the component is expected to be a follows: 2023 2024 2025 2026 Demand (units) 38,000 42,000 50,000 23,000 The selling price of the component is expected to be 11.00 per unit and the variable cost of production will be 7.50 per unit with incremental annual fixed overheads of 35,000. All of these forecasts are quoted in current terms. The general rate of inflation over the relevant period is expected to be 5% per inflate as follows each year: Selling price 3% per annum Variable cost of production 4% per annum Fixed production overheads 6% per annum return of 5.7% per annum. The company operates with a target Capital Employed of 20% and depreciation is charged on a straight-line basis over the life of an asset. Required: a) Calculate the net present value of buying the machine and comment on your findings. Should you accept this project based on NPV or reject? (14 marks) b) Calculate the internal rate of return (based on a higher rate of return 19%} of the investment and comment on your findings. Should you accept this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts