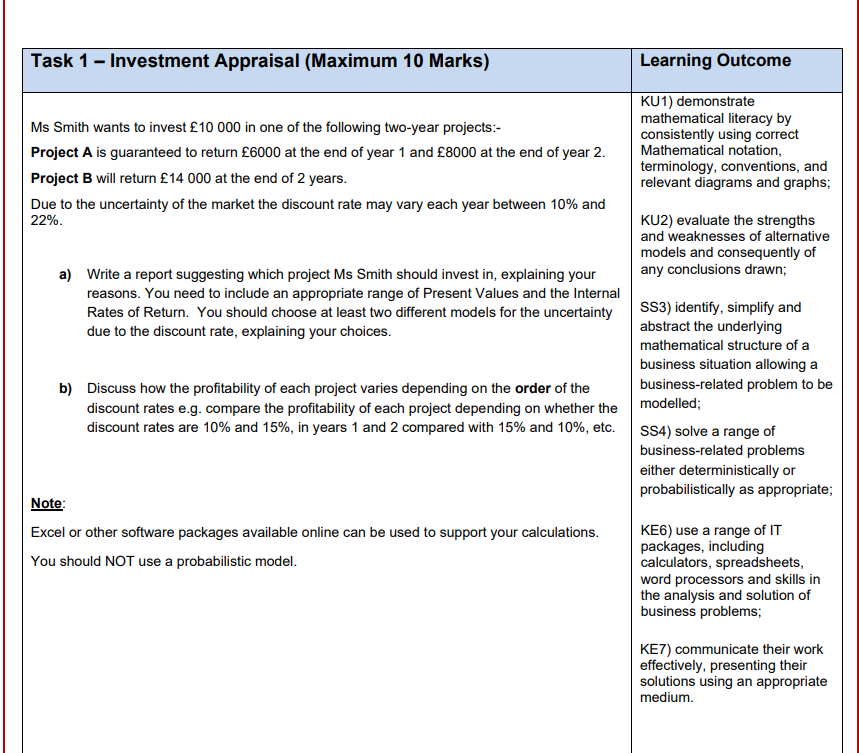

Question: Task 1 - Investment Appraisal (Maximum 10 Marks) Learning Outcome Ms Smith wants to invest 10 000 in one of the following two-year projects:- Project

Task 1 - Investment Appraisal (Maximum 10 Marks) Learning Outcome Ms Smith wants to invest 10 000 in one of the following two-year projects:- Project A is guaranteed to return 6000 at the end of year 1 and 8000 at the end of year 2. Project B will return 14 000 at the end of 2 years. Due to the uncertainty of the market the discount rate may vary each year between 10% and 22%. KU1) demonstrate mathematical literacy by consistently using correct Mathematical notation, terminology, conventions, and relevant diagrams and graphs; KU2) evaluate the strengths and weaknesses of alternative models and consequently of any conclusions drawn; a) Write a report suggesting which project Ms Smith should invest in, explaining your reasons. You need to include an appropriate range of Present Values and the Internal Rates of Return. You should choose at least two different models for the uncertainty due to the discount rate, explaining your choices. b) Discuss how the profitability of each project varies depending on the order of the discount rates e.g. compare the profitability of each project depending on whether the discount rates are 10% and 15%, in years 1 and 2 compared with 15% and 10%, etc. SS3) identify, simplify and abstract the underlying mathematical structure of a business situation allowing a business-related problem to be modelled; SS4) solve a range of business-related problems either deterministically or probabilistically as appropriate; Note: Excel or other software packages available online can be used to support your calculations. You should NOT use a probabilistic model. KE6) use a range of IT packages, including calculators, spreadsheets, word processors and skills in the analysis and solution of business problems; KE7) communicate their work effectively, presenting their solutions using an appropriate medium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts