Question: Task # 1 ( Portfolio frontier ) . Assume that you have two risky assets, namely a stock index ( asset 1 ) with monthly

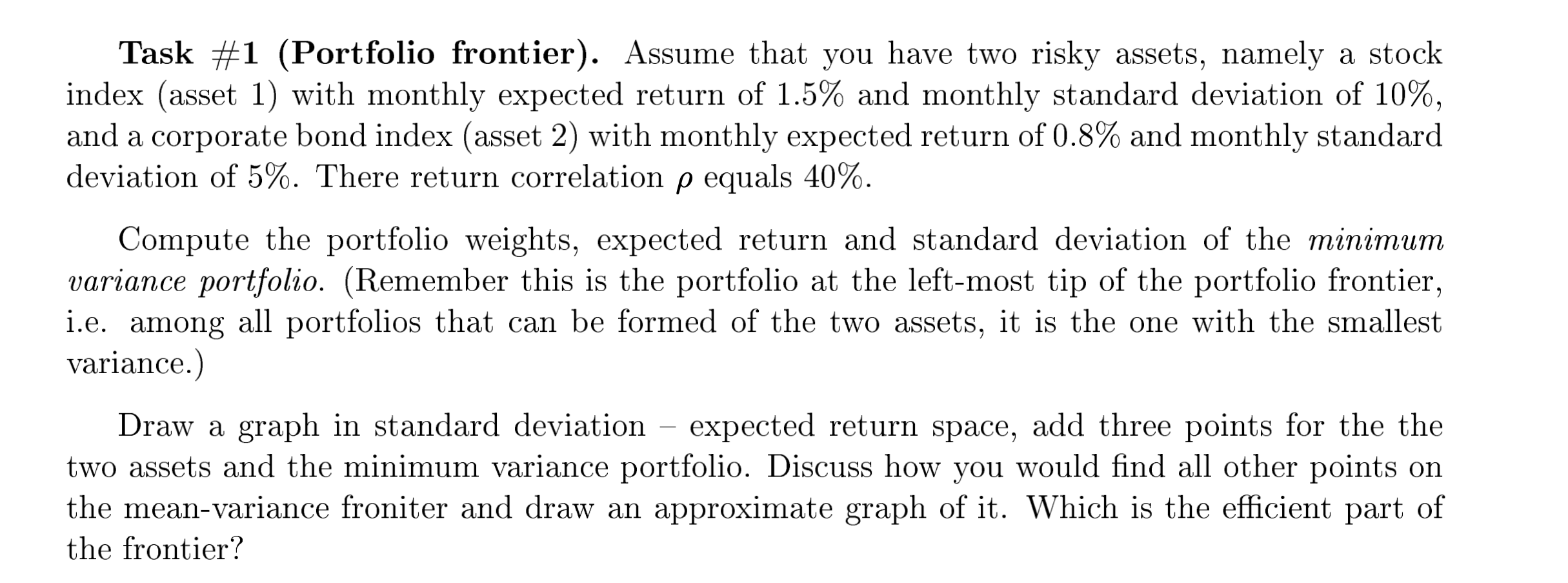

Task #Portfolio frontier Assume that you have two risky assets, namely a stock

index asset with monthly expected return of and monthly standard deviation of

and a corporate bond index asset with monthly expected return of and monthly standard

deviation of There return correlation equals

Compute the portfolio weights, expected return and standard deviation of the minimum

variance portfolio. Remember this is the portfolio at the leftmost tip of the portfolio frontier,

ie among all portfolios that can be formed of the two assets, it is the one with the smallest

variance.

Draw a graph in standard deviation expected return space, add three points for the the

two assets and the minimum variance portfolio. Discuss how you would find all other points on

the meanvariance froniter and draw an approximate graph of it Which is the efficient part of

the frontier?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock