Question: Task 2 (20 marks) After graduation, you work as a Financial Analyst in a reputable multinational company in Kuala Lumpur. Your superior has assigned you

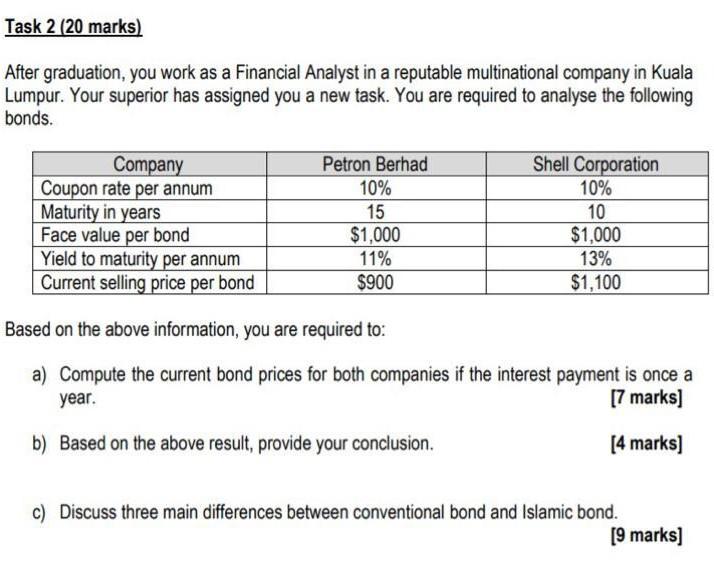

Task 2 (20 marks) After graduation, you work as a Financial Analyst in a reputable multinational company in Kuala Lumpur. Your superior has assigned you a new task. You are required to analyse the following bonds. Company Coupon rate per annum Maturity in years Face value per bond Yield to maturity per annum Current selling price per bond Petron Berhad 10% 15 $1,000 11% $900 Shell Corporation 10% 10 $1,000 13% $1,100 Based on the above information, you are required to: a) Compute the current bond prices for both companies if the interest payment is once a year. [7 marks] b) Based on the above result, provide your conclusion. [4 marks] c) Discuss three main differences between conventional bond and Islamic bond. [9 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts