Question: Task 2 (20 marks) After graduation, you work as a Financial Analyst in a reputable multinational company in Kuala Lumpur. Your superior has assigned you

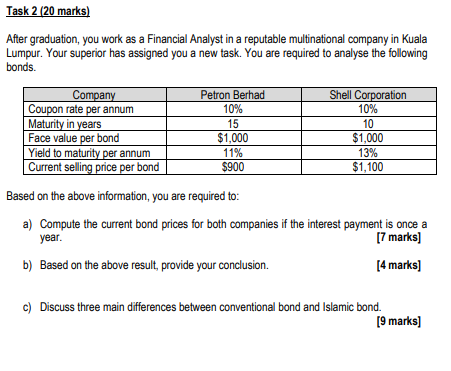

Task 2 (20 marks) After graduation, you work as a Financial Analyst in a reputable multinational company in Kuala Lumpur. Your superior has assigned you a new task. You are required to analyse the following bonds. Company Petron Berhad Shell Corporation Coupon rate per annum 10% 10% Maturity in years 15 10 Face value per bond $1,000 $1,000 Yield to maturity per annum 11% 13% Current selling price per bond $900 $1,100 Based on the above information, you are required to: a) Compute the current bond prices for both companies if the interest payment is once a year. [7 marks) b) Based on the above result, provide your conclusion. [4 marks) c) Discuss three main differences between conventional bond and Islamic bond. [9 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts