Question: Task - Based on the information provided, determine if there are any unrecorded liabilities related to accrued expenses, particularly related to GET expense as of

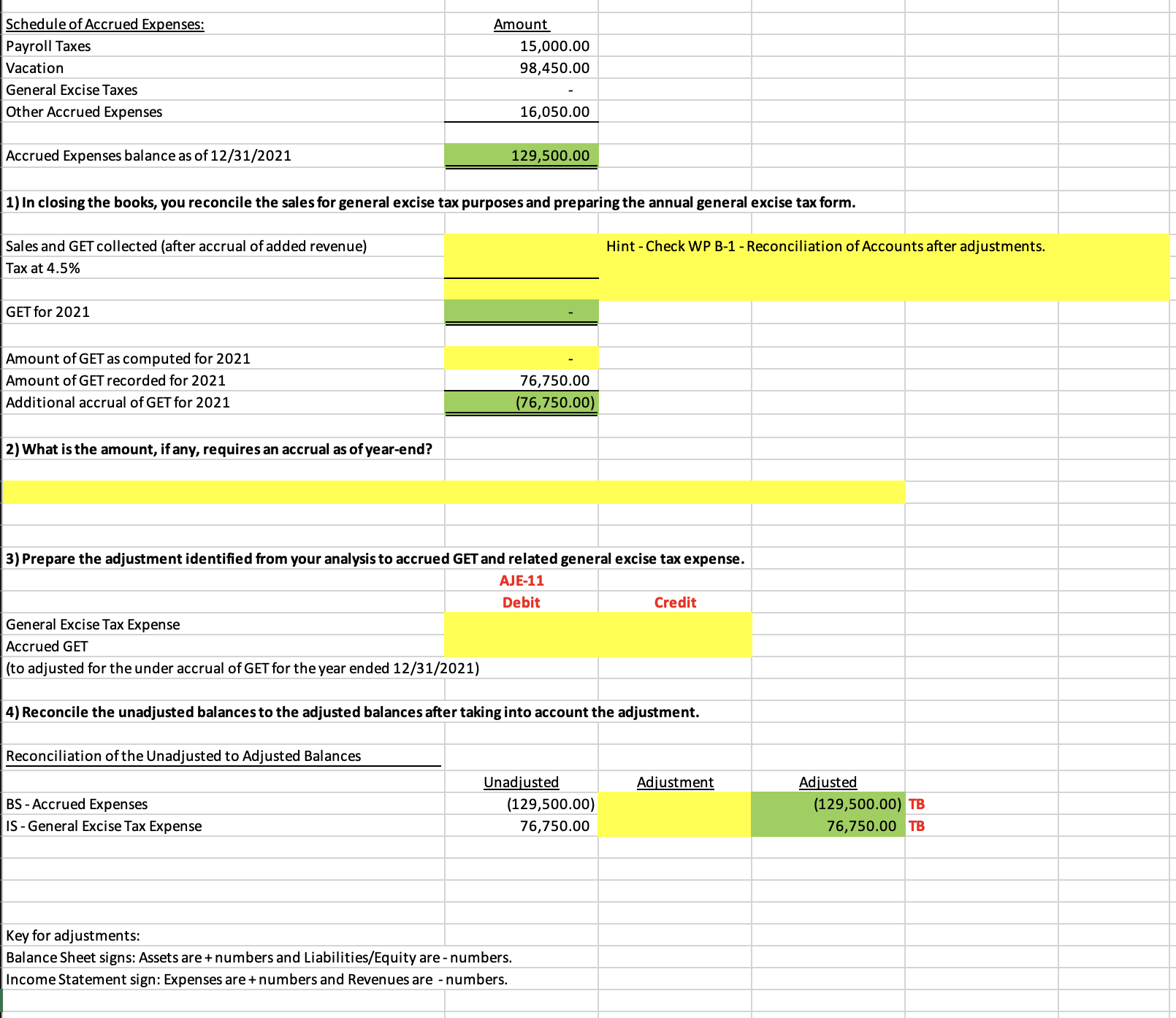

Task Based on the information provided, determine if there are any unrecorded liabilities related to accrued expenses, particularly related to GET expense as of GET is based on sales revenue reported for the year. Compute the GET liability based on the adjusted revenue amount for the year. Apply the GET rate and determine the amount computed for the year ended Compare the amount of the GET liability to the amount paid and determine if there are any amounts still due at the end of the year Determine the adjustment required to properly state the accrued expenses as of and the related expenses for the year ended based on the informtion presented.

In closing the books, you reconcile the sales for general excise tax purposes and preparing the annual general excise tax form.

Sales and GET collected after accrual of added revenue

Hint Check WP B Reconciliation of Accounts after adjustments.

Tax at

GET for

What is the amount, if any, requires an accrual as of yearend?

Prepare the adjustment identified from your analysis to accrued GET and related general excise tax expense.

Please fill in yellow sections please, thank you!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock