Question: Tax Drill - Determining Filing Status Indicate the most advantageous filing status for the following taxpayers. Select Single, Married, filing jointly, Head of household, Married,

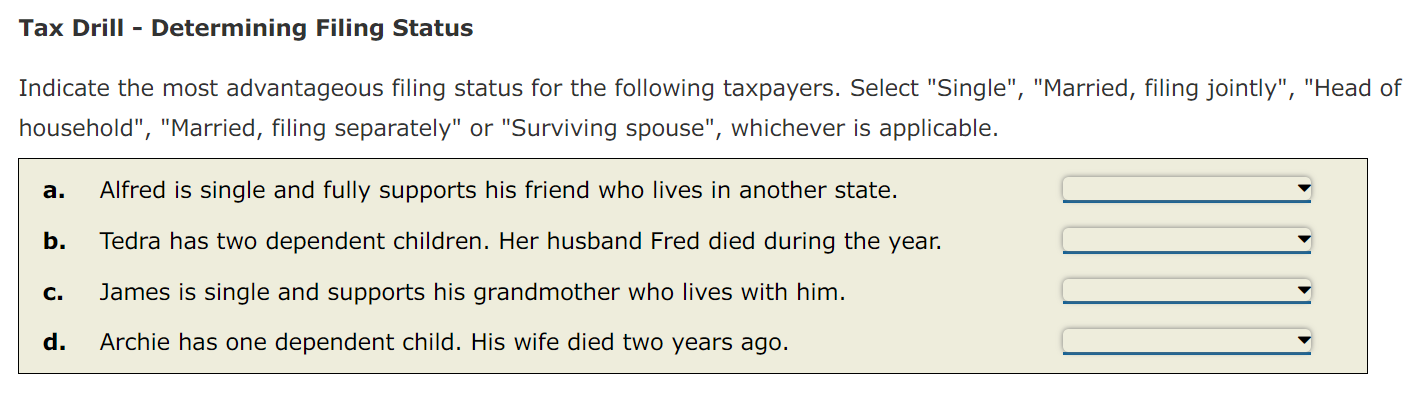

Tax Drill Determining Filing Status

Indicate the most advantageous filing status for the following taxpayers. Select "Single", "Married, filing jointly", "Head of

household", "Married, filing separately" or "Surviving spouse", whichever is applicable.

a Alfred is single and fully supports his friend who lives in another state.

b Tedra has two dependent children. Her husband Fred died during the year.

c James is single and supports his grandmother who lives with him.

d Archie has one dependent child. His wife died two years ago.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock