Question: Tax Drill - Section 1 2 1 Indicate whether the following statements are True or False regarding the tax treatment of the sale of a

Tax Drill Section

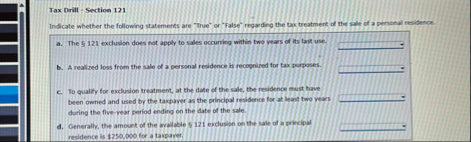

Indicate whether the following statements are "True" or "False" regarding the tax treatment of the sale of a penchal resibence:

a The exclusion does not apply to sales occurring within two yoars of its last une

b A realized loss from the sale of a personal residence is recognized for tax porposes.

C To qualify for exclusion treatment, at the date of the sale, the residence must have been owned and used by the taxpayer as the principal residence for at least two years during the flvevear period ending on the date of the sate.

d Generally, the amount of the avalable exclugion on the sale of a principal residence is $ for a tavpaver.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock