Question: Tax Drill - Section 2 2 2 Complete the statements below regarding Section 2 2 2 . Under 5 2 2 2 , a deduction

Tax Drill Section

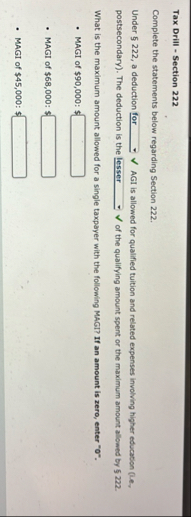

Complete the statements below regarding Section

Under a deduction AGI is allowed for qualified tuition and related expenses involving higher education le postsecondary The deduction is the lesser of the qualifying amount spent or the maximum amount allowed by What is the maximum amount allowed for a single taxpayer with the following MAGI? If an amount is zero, enter

MAGI of $:

MAGI of $:

MAGI of $:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock