Question: Tax Drill - Section 222 Complete the statements below regarding Section 222. Under $ 222, a deduction for AGI is allowed for qualified tuition and

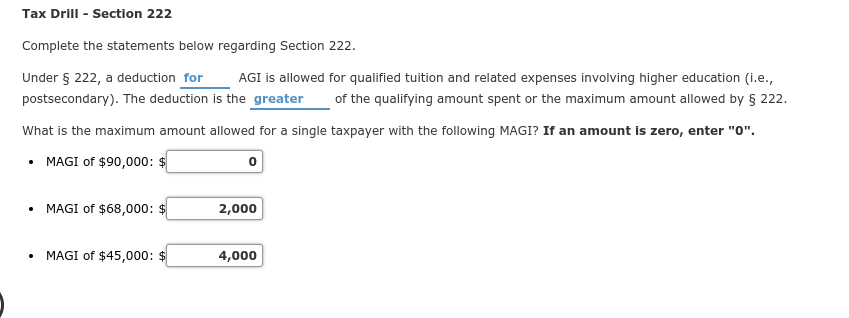

Tax Drill - Section 222 Complete the statements below regarding Section 222. Under $ 222, a deduction for AGI is allowed for qualified tuition and related expenses involving higher education i.e., postsecondary). The deduction is the greater of the qualifying amount spent or the maximum amount allowed by $ 222. What is the maximum amount allowed for a single taxpayer with the following MAGI? If an amount is zero, enter "0". MAGI of $90,000: $ 0 MAGI of $68,000: $ 2,000 MAGI of $45,000: $ 4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts