Question: Tax Drill - Selection for Audit Indicate whether the following statements are True or False regarding the selection of tax returns for audit. a .

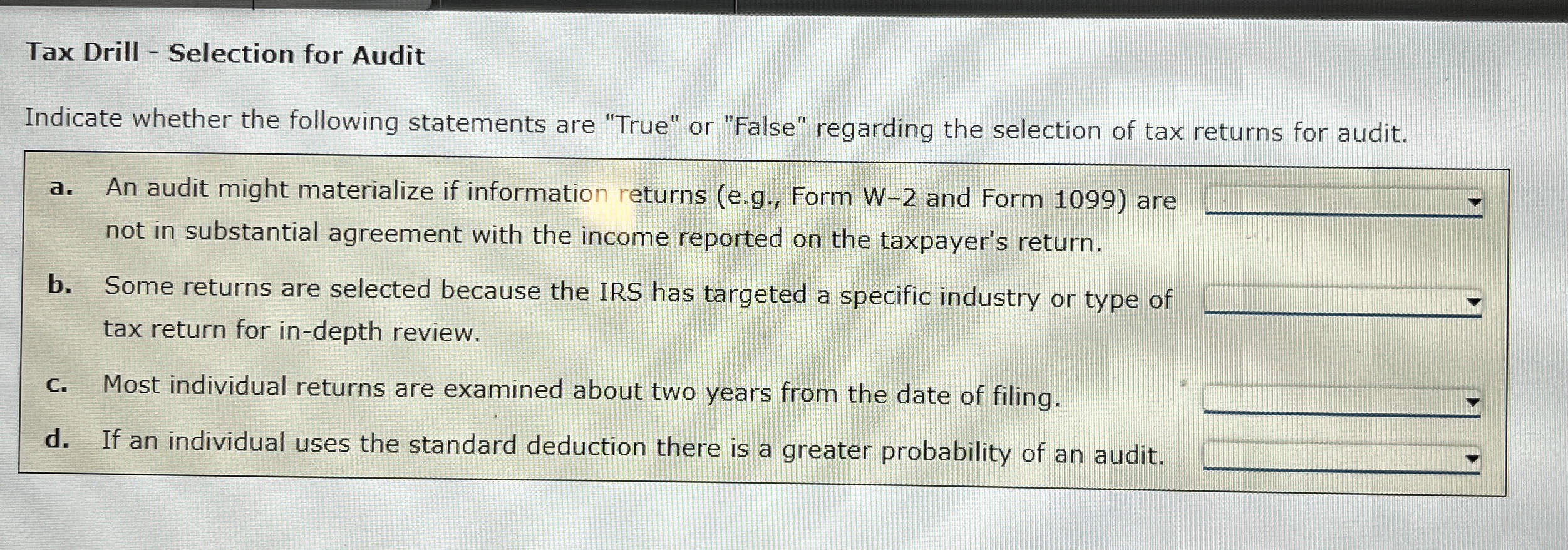

Tax Drill Selection for Audit

Indicate whether the following statements are "True" or "False" regarding the selection of tax returns for audit.

a An audit might materialize if information returns eg Form W and Form are not in substantial agreement with the income reported on the taxpayer's return.

b Some returns are selected because the IRS has targeted a specific industry or type of tax return for indepth review.

c Most individual returns are examined about two years from the date of filing.

d If an individual uses the standard deduction there is a greater probability of an audit.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock