Question: Tax Forms Problem On November 1 , 2 0 1 2 , Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and

Tax Forms Problem

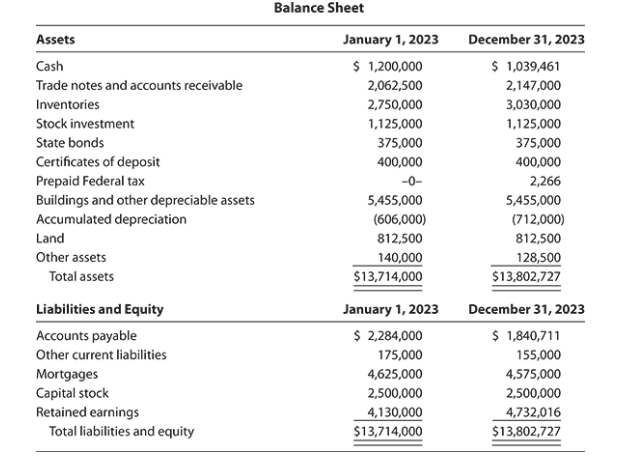

On November Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows:Balance Sheet

tableAssetsJanuary December Cash$ $ Trade notes and accounts receivable,InventoriesStock investment,State bonds,Certificates of deposit,Prepaid Federal tax,Buildings and other depreciable assets,Accumulated depreciation,LandOther assets,Total assets,$$Liabilities and Equity,January December Accounts payable,$ $ Other current liabilities,MortgagesCapital stock,Retained earnings,Total liabilities and equity,$$

Pet Kingdoms business address is Northwest Parkway, Dallas, TX ; its telephone number is ; and its email address is petkingdom@pki.com.

The employer identification number is and the principal business activity code is

Janet and Kim each own of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized.

Both Janet and Kim are fulltime employees of Pet Kingdom. Janets Social Security number is and Kims Social Security number is

Pet Kingdom is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. Pet Kingdom uses the straightline method of depreciation for book purposes and accelerated depreciation MACRS for tax purposes.

During the corporation distributed cash dividends of $

The corporation did not own or use any digital assets during the year.

Pet Kingdoms financial statements for are shown below.

Details

Depreciation for tax purposes is $ You are not provided enough detailed data to complete a Form depreciation If you solve this problem using Intuit ProConnect, enter the amount of depreciation on line of Form

Details

During Pet Kingdom made estimated tax payments of $ each quarter to the IRS. Prepare Pet Kingdoms corporate tax return for tax year using Form and any other appropriate forms and schedules Suggested software: ProConnect Tax. Part II Reconciliation of Net Income Loss per Income Statement of Includible Corporations With Taxable

Income per Return see instructions

Need these forms filled with the data above.

Income Statement

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock