Question: Tax Fraud Case Study Prepare the Case Study as outlined in For this assignment, please prepare a case study focused on one instance of tax

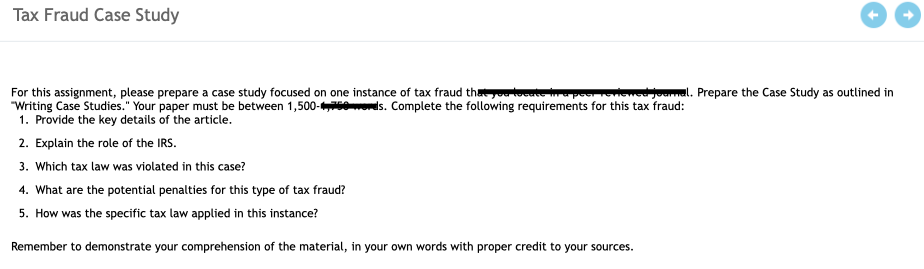

Tax Fraud Case Study Prepare the Case Study as outlined in For this assignment, please prepare a case study focused on one instance of tax fraud that you toeste "Writing Case Studies." Your paper must be between 1,500-ods. Complete the following requirements for this tax fraud: 1. Provide the key details of the article. 2. Explain the role of the IRS. 3. Which tax law was violated in this case? 4. What are the potential penalties for this type of tax fraud? 5. How was the specific tax law applied in this instance? Remember to demonstrate your comprehension of the material, in your own words with proper credit to your sources. Tax Fraud Case Study Prepare the Case Study as outlined in For this assignment, please prepare a case study focused on one instance of tax fraud that you toeste "Writing Case Studies." Your paper must be between 1,500-ods. Complete the following requirements for this tax fraud: 1. Provide the key details of the article. 2. Explain the role of the IRS. 3. Which tax law was violated in this case? 4. What are the potential penalties for this type of tax fraud? 5. How was the specific tax law applied in this instance? Remember to demonstrate your comprehension of the material, in your own words with proper credit to your sources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts