Question: Tax Return Problem 3 Kathy and Rob Alvarez obtained a divorce effective May 1 , 2 0 1 7 , and there have been no

Tax Return Problem

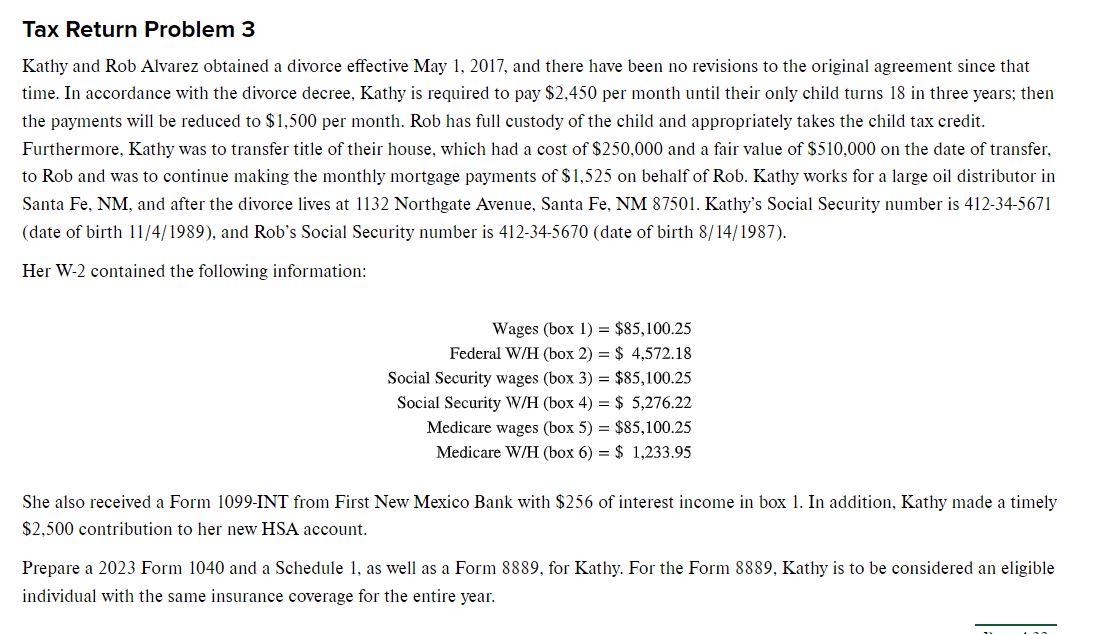

Kathy and Rob Alvarez obtained a divorce effective May and there have been no revisions to the original agreement since that

time. In accordance with the divorce decree, Kathy is required to pay $ per month until their only child turns in three years; then

the payments will be reduced to $ per month. Rob has full custody of the child and appropriately takes the child tax credit.

Furthermore, Kathy was to transfer title of their house, which had a cost of $ and a fair value of $ on the date of transfer,

to Rob and was to continue making the monthly mortgage payments of $ on behalf of Rob. Kathy works for a large oil distributor in

Santa Fe NM and after the divorce lives at Northgate Avenue, Santa Fe NM Kathy's Social Security number is

date of birth and Rob's Social Security number is date of birth

Her W contained the following information:

Wages $

Federal$

Social Security wages $

Social Security$

Medicare wages $

Medicare$

She also received a Form INT from First New Mexico Bank with $ of interest income in box In addition, Kathy made a timely

$ contribution to her new HSA account.

Prepare a Form and a Schedule as well as a Form for Kathy. For the Form Kathy is to be considered an eligible

individual with the same insurance coverage for the entire year. Complete tax return problem at the end of chapter The return you are preparing is for Kathy Alvarez. Please use the TaxAct software to complete the return. Please make the following changesadditions to the material in the textbook:

Change the address of this taxpayer to Pewaukee, WI Assume Kathys employer is located in Wisconsin.

Kathy also received $ of municipal interest income.

Kathy also received $ of US Government interest.

Kathy had $ of Wisconsin withholding on his wages.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock