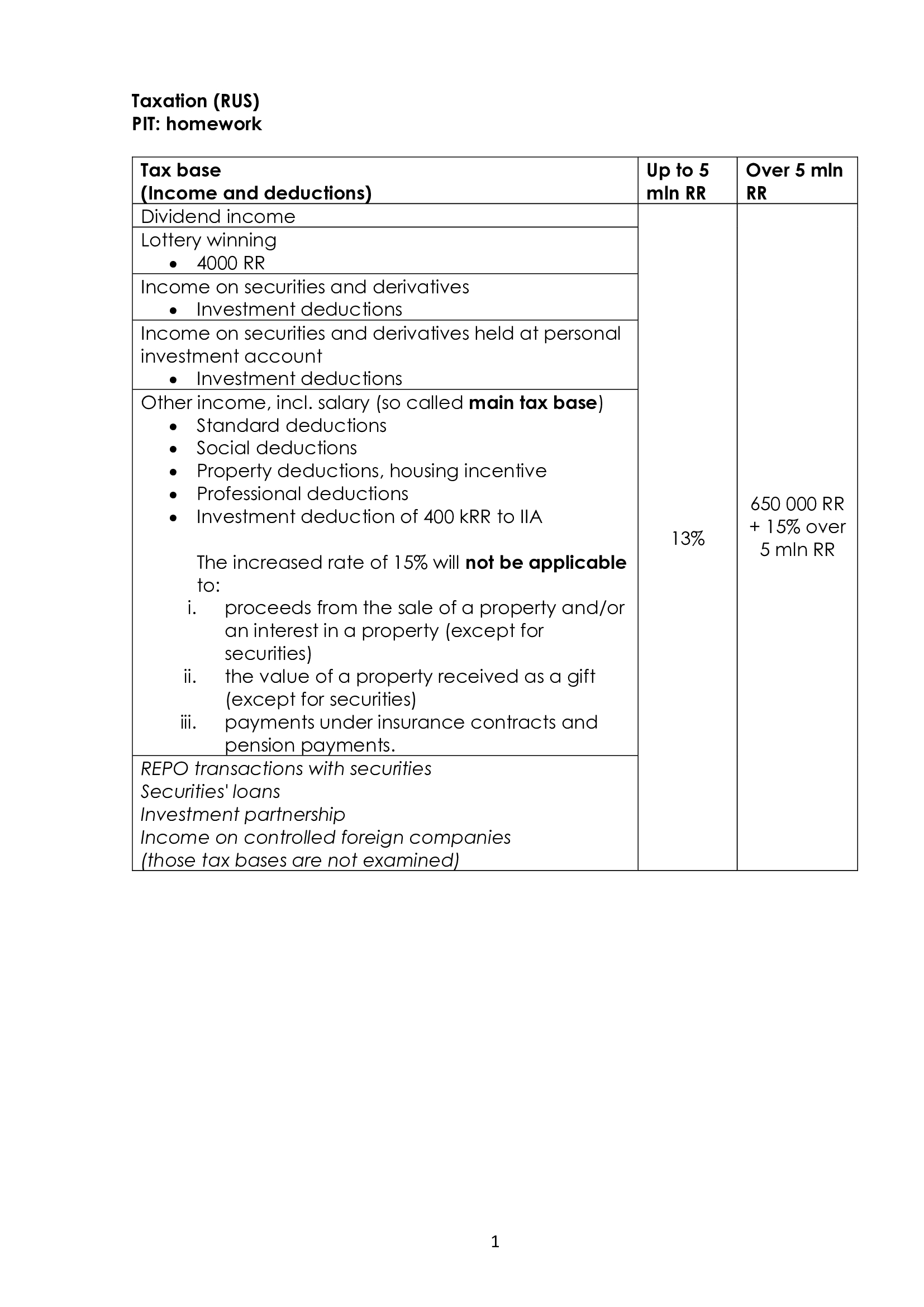

Question: Taxation ( RUS ) PIT: homework begin { tabular } { | c | c | c | } hline Tax base (

Taxation RUS

PIT: homework

begintabularccc

hline Tax base Income and deductions & Up to mln RR & Over mln RR

hline Dividend income & &

hline begintabularl

Lottery winning

RR

endtabular & &

hline begintabularl

Income on securities and derivatives

Investment deductions

endtabular & &

hline begintabularl

Income on securities and derivatives held at personal investment account

Investment deductions

endtabular & &

hline begintabularl

Other income, incl. salary so called main tax base

Standard deductions

Social deductions

Property deductions, housing incentive

Professional deductions

Investment deduction of kRR to IIA

The increased rate of will not be applicable to:

i proceeds from the sale of a property andor an interest in a property except for securities

ii the value of a property received as a gift except for securities

iii. payments under insurance contracts and pension payments.

endtabular & & begintabularl

RR

over mln RR

endtabular

hline begintabularl

REPO transactions with securities

Securities' loans

Investment partnership

Income on controlled foreign companies

those tax bases are not examined

endtabular & &

hline

endtabular

Taxable income

Julia works as a sales manager for a trading company. Her net salary for each month in was RR On the text st of March she was awarded a performance bonus for the last year in the amount of RR net amount which she deposited in a bank for months at the interest rate of the next day.

In she sold her summerhouse for RR as she inherited a new cottage from her uncle at the market value of RR

In May Julia bought a new car which unfortunately got into accident. Julia received RR of insurance payment from insurance company.

During the year she traveled a lot on business and the total amount reimbursed to her by her company was RR within statutory norms She also got a voucher for trip to Egypt as a gift from her company valued at RR

Her employer also reimbursed her interest paid by Julia on her mortgage loan in the amount of RR

In March she received RR of dividends net of taxes from PAO "Gprom" for the year

Required: Calculate taxable income for Julia for the year Show separately each item of taxable and exempt income. Ignore deductions.

Property deductions

Aleksey is a tax resident. In he sold the following property:

On October Aleksey decided to sell his personal car for RR The car was received by Alexey as a gift in

In June Aleksey and his wife decided to sell a summerhouse with the plot of land in the Moscow region for RR Their ownership of this summerhouse and plot of land was split from The purchase value of the plot of land was RR in

In December Aleksey sold his garage for RR He bought this garage in with the purchase cost of RR He kept all the documents in relation to purchase of the garage. Cadastral value of estate property at sale date is RR

Required: a Calculate the amount of personal income tax for in relation to the operations described above. Assume that all the necessary supporting documents are available. b Calculate the amount of personal income tax for in relation to the operations described above in case the purchase cost of garage was RR Assume that all the necessary supporting documents are available.

Interest income

Elena opened the following deposits in in Russian banks:

Required: calculate PIT for

Dividends

Anton owns shares of the company GRANAT. The total number of the company's issued shares was owned by Russian legal entities. In September the shareholders of GRANAT decided to distribute as dividend of the aftertax profits of the financial year. The total amount of profits before tax equal to the taxable profits subject to standard CPT rate per the annual tax return was mln RR and the dividends were paid in December

The net amount of interim dividends received by GRANAT from its subsidiary company KOT in was mln RR not qualified for rate and mathrmmln R R from subsidiary company JEL qualified for rate

Required: Calculate personal income tax on dividends received by Anton, net amount received by Anton and explain the procedure of this tax payment to the budget.

Investment deduction

Pavel is a local manager of the bank. His gross monthly salary is RR in

He sold listed securities Sber bank in his broker account on September, at a price of RR per share. Also Pavel invested RR on his individual investment account type A which was opened in January

Required:

a calculate PIT for as if he did not close his IIA account.

b calculate PIT for as if he closed his IIA account on Dec

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock