Question: Taylor, age 18 , is claimed as a dependent by her parents. For 2022, she has the following income: $6,250 wages from a summer job,

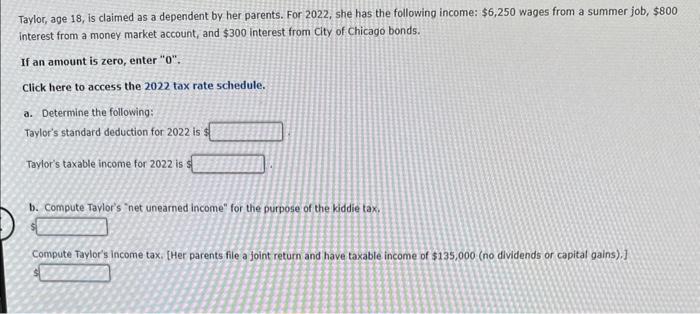

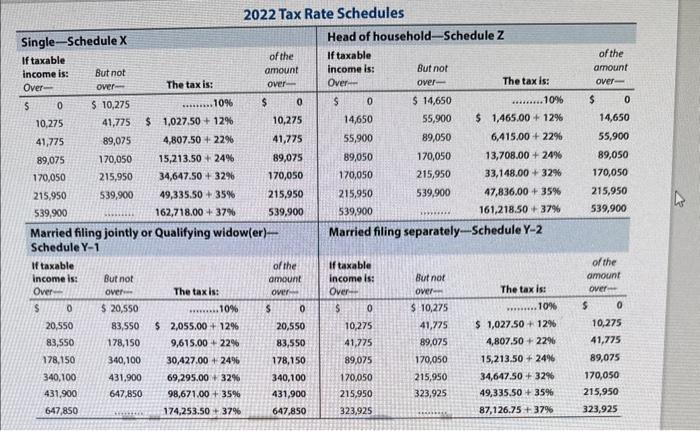

Taylor, age 18 , is claimed as a dependent by her parents. For 2022, she has the following income: $6,250 wages from a summer job, $800 interest from a money market account, and $300 interest from City of chicago bonds. If an amount is zero, enter " 0 ". Click here to access the 2022 tax rate schedule. a. Determine the following: Taylor's standard deduction for 2022 is 4 Taylor's taxable income for 2022 is 5 b. Compute Taylor's "net unearned income" for the purpose of the kiddie tax. Compute Taylor's income tax. [Her parents file a joint return and have taxable income of $135,000 (no dividends or capital gains).] 2022 Tax Rate Schedules

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts