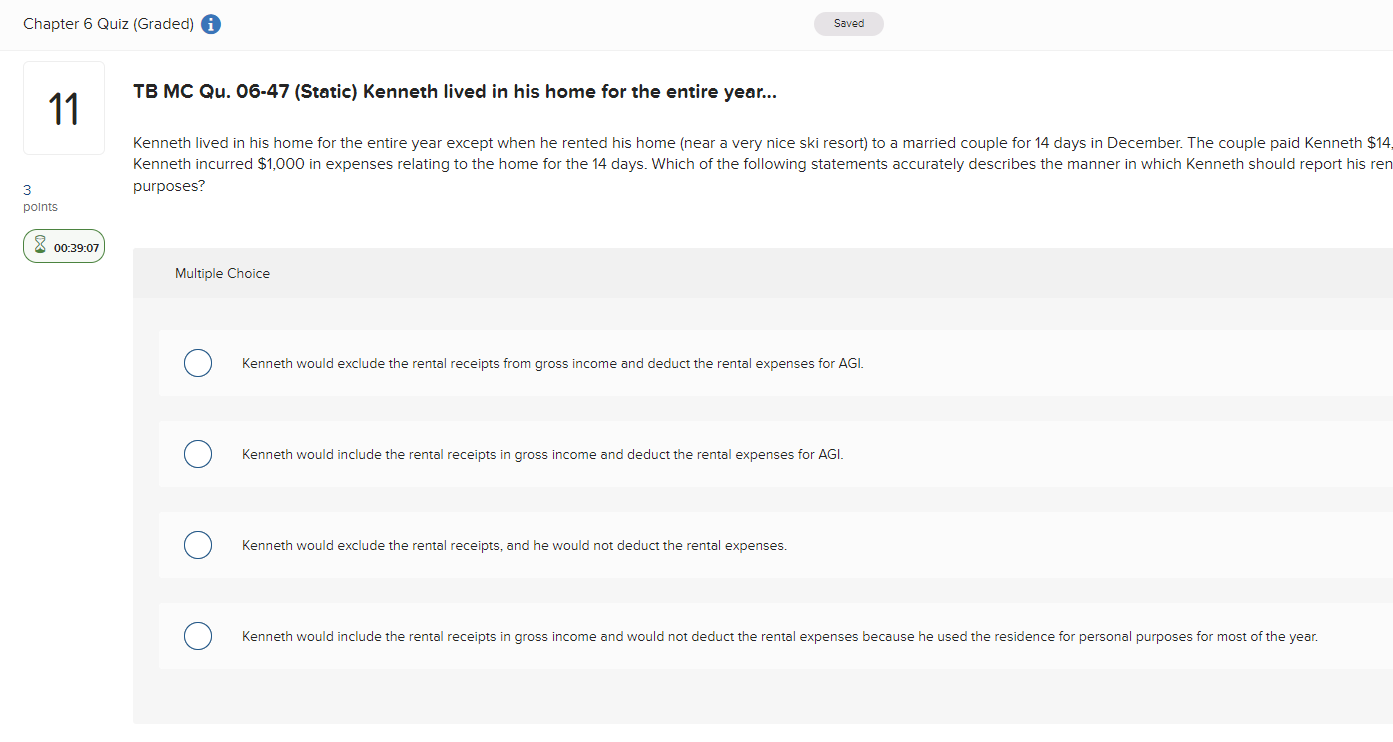

Question: TB MC Qu . 0 6 - 4 7 ( Static ) Kenneth lived in his home for the entire year... Kenneth lived in his

TB MC QuStatic Kenneth lived in his home for the entire year...

Kenneth lived in his home for the entire year except when he rented his home near a very nice ski resort to a married couple for days in December. The couple paid Kenneth $

Kenneth incurred $ in expenses relating to the home for the days. Which of the following statements accurately describes the manner in which Kenneth should report his ren

purposes?

Multiple Choice

Kenneth would exclude the rental receipts from gross income and deduct the rental expenses for AGI.

Kenneth would include the rental receipts in gross income and deduct the rental expenses for AGI.

Kenneth would exclude the rental receipts, and he would not deduct the rental expenses.

Kenneth would include the rental receipts in gross income and would not deduct the rental expenses because he used the residence for personal purposes for most of the year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock