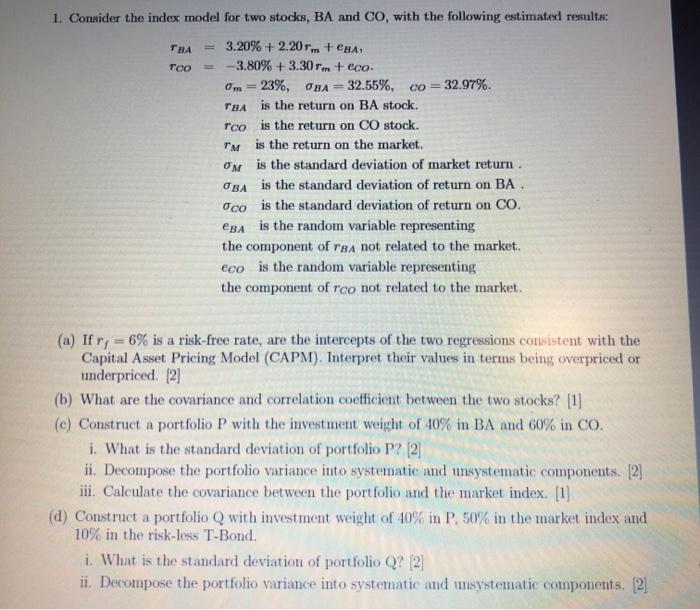

Question: TBA 1. Consider the index model for two stocks, BA and CO, with the following estimated results: = 3.20% +2.20rm + BA, co -3.80% +3.30

TBA 1. Consider the index model for two stocks, BA and CO, with the following estimated results: = 3.20% +2.20rm + BA, co -3.80% +3.30 rm + eco. 0m = 23%, OBA = 32.55%, co = 32.97%. TBA is the return on BA stock. rco is the return on CO stock. TM is the return on the market. on is the standard deviation of market return OBA is the standard deviation of return on BA. Oco is the standard deviation of return on CO. CBA is the random variable representing the component of a not related to the market. eco is the random variable representing the component of rco not related to the market. (a) If r;= 6% is a risk-free rate, are the intercepts of the two regressions consistent with the Capital Asset Pricing Model (CAPM). Interpret their values in terms being overpriced or underpriced. [2] (b) What are the covariance and correlation coefficient between the two stocks? [1] (c) Construct a portfolio P with the investment weight of 40% in BA and 60% in CO. i. What is the standard deviation of portfolio P? 2 ii. Decompose the portfolio variance into systematic and unsystematic components. [2] iii. Calculate the covariance between the portfolio and the market index. (1) (d) Construct a portfolio Q with investment weight of 40% in P. 50% in the market index and 10% in the risk-less T-Bond. i. What is the standard deviation of portfolio Q? (2) ii. Decompose the portfolio variance into systematic and systematic components. [2] TBA 1. Consider the index model for two stocks, BA and CO, with the following estimated results: = 3.20% +2.20rm + BA, co -3.80% +3.30 rm + eco. 0m = 23%, OBA = 32.55%, co = 32.97%. TBA is the return on BA stock. rco is the return on CO stock. TM is the return on the market. on is the standard deviation of market return OBA is the standard deviation of return on BA. Oco is the standard deviation of return on CO. CBA is the random variable representing the component of a not related to the market. eco is the random variable representing the component of rco not related to the market. (a) If r;= 6% is a risk-free rate, are the intercepts of the two regressions consistent with the Capital Asset Pricing Model (CAPM). Interpret their values in terms being overpriced or underpriced. [2] (b) What are the covariance and correlation coefficient between the two stocks? [1] (c) Construct a portfolio P with the investment weight of 40% in BA and 60% in CO. i. What is the standard deviation of portfolio P? 2 ii. Decompose the portfolio variance into systematic and unsystematic components. [2] iii. Calculate the covariance between the portfolio and the market index. (1) (d) Construct a portfolio Q with investment weight of 40% in P. 50% in the market index and 10% in the risk-less T-Bond. i. What is the standard deviation of portfolio Q? (2) ii. Decompose the portfolio variance into systematic and systematic components. [2]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts