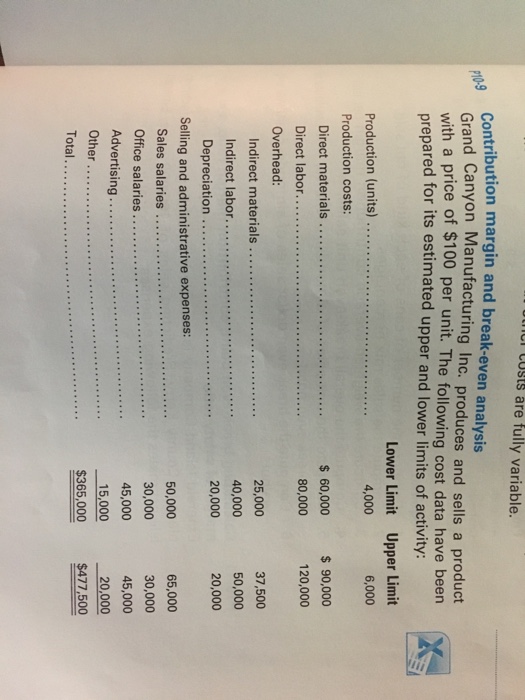

Question: tCusts are fully variable Contribution margin and break-even analysis Grand Canyon 0-9 Manufacturing Inc. produces and sells a product h a price of $100 per

tCusts are fully variable Contribution margin and break-even analysis Grand Canyon 0-9 Manufacturing Inc. produces and sells a product h a price of $100 per unit. The following cost data have been prepared Production (units) Production costs Lower Limit 4,000 Upper Limit 6,000 $ 60,000 90,000 120,000 Direct materials . 80,000 Overhead 25,000 40,000 20,000 37,500 50,000 20,000 Indirect materials .. Indirect labor Depreciation Selling and administrative expenses: Sales salaries Office salaries Advertising Other 50,000 30,000 45,000 15,000 $365,000 65,000 30,000 45,000 20,000 $477,500 tCusts are fully variable Contribution margin and break-even analysis Grand Canyon 0-9 Manufacturing Inc. produces and sells a product h a price of $100 per unit. The following cost data have been prepared Production (units) Production costs Lower Limit 4,000 Upper Limit 6,000 $ 60,000 90,000 120,000 Direct materials . 80,000 Overhead 25,000 40,000 20,000 37,500 50,000 20,000 Indirect materials .. Indirect labor Depreciation Selling and administrative expenses: Sales salaries Office salaries Advertising Other 50,000 30,000 45,000 15,000 $365,000 65,000 30,000 45,000 20,000 $477,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts