Question: Team exercise 3c - A proposal for a new MRI machine 16 points A new MRI machine costs $3 million. You have a 4-year planning

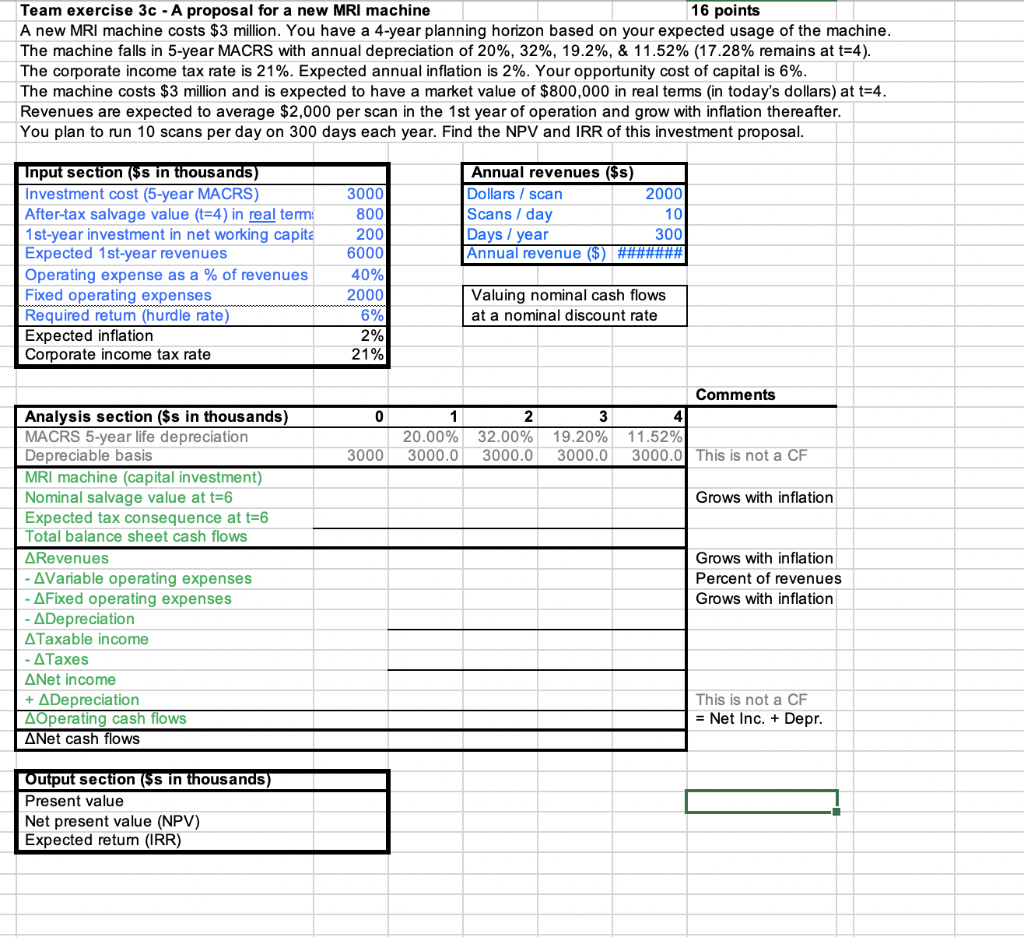

Team exercise 3c - A proposal for a new MRI machine 16 points A new MRI machine costs $3 million. You have a 4-year planning horizon based on your expected usage of the machine. The machine falls in 5-year MACRS with annual depreciation of 20%, 32%, 19.2%, & 11.52% (17.28% remains at t=4). The corporate income tax rate is 21%. Expected annual inflation is 2%. Your opportunity cost of capital is 6%. The machine costs $3 million and is expected to have a market value of $800,000 in real terms (in today's dollars) at t=4. Revenues are expected to average $2,000 per scan in the 1st year of operation and grow with inflation thereafter. You plan to run 10 scans per day on 300 days each year. Find the NPV and IRR of this investment proposal. Annual revenues ($s) Dollars / scan 2000 Scans / day 10 Days / year 300 Annual revenue ($) ####### Input section ($s in thousands) Investment cost (5-year MACRS) After-tax salvage value (t=4) in real term: 1 st-year investment in net working capita Expected 1 st-year revenues Operating expense as a % of revenues Fixed operating expenses Required retum (hurdle rate) Expected inflation Corporate income tax rate 3000 800 200 6000 40% 2000 6% 2% 21% Valuing nominal cash flows at a nominal discount rate Comments 0 1 2 20.00% 32.00% 3000.0 3000.0 3 19.20% 3000.0 11.52% 3000.0 This is not a CF 3000 Grows with inflation Analysis section ($s in thousands) MACRS 5-year life depreciation Depreciable basis MRI machine (capital investment) Nominal salvage value at t=6 Expected tax consequence at t=6 Total balance sheet cash flows ARevenues - AVariable operating expenses - AFixed operating expenses - ADepreciation ATaxable income - ATaxes ANet income ADepreciation Operating cash flows ANet cash flows Grows with inflation Percent of revenues Grows with inflation This is not a CF = Net Inc. + Depr. Output section ($s in thousands) Present value Net present value (NPV) Expected retum (IRR) Team exercise 3c - A proposal for a new MRI machine 16 points A new MRI machine costs $3 million. You have a 4-year planning horizon based on your expected usage of the machine. The machine falls in 5-year MACRS with annual depreciation of 20%, 32%, 19.2%, & 11.52% (17.28% remains at t=4). The corporate income tax rate is 21%. Expected annual inflation is 2%. Your opportunity cost of capital is 6%. The machine costs $3 million and is expected to have a market value of $800,000 in real terms (in today's dollars) at t=4. Revenues are expected to average $2,000 per scan in the 1st year of operation and grow with inflation thereafter. You plan to run 10 scans per day on 300 days each year. Find the NPV and IRR of this investment proposal. Annual revenues ($s) Dollars / scan 2000 Scans / day 10 Days / year 300 Annual revenue ($) ####### Input section ($s in thousands) Investment cost (5-year MACRS) After-tax salvage value (t=4) in real term: 1 st-year investment in net working capita Expected 1 st-year revenues Operating expense as a % of revenues Fixed operating expenses Required retum (hurdle rate) Expected inflation Corporate income tax rate 3000 800 200 6000 40% 2000 6% 2% 21% Valuing nominal cash flows at a nominal discount rate Comments 0 1 2 20.00% 32.00% 3000.0 3000.0 3 19.20% 3000.0 11.52% 3000.0 This is not a CF 3000 Grows with inflation Analysis section ($s in thousands) MACRS 5-year life depreciation Depreciable basis MRI machine (capital investment) Nominal salvage value at t=6 Expected tax consequence at t=6 Total balance sheet cash flows ARevenues - AVariable operating expenses - AFixed operating expenses - ADepreciation ATaxable income - ATaxes ANet income ADepreciation Operating cash flows ANet cash flows Grows with inflation Percent of revenues Grows with inflation This is not a CF = Net Inc. + Depr. Output section ($s in thousands) Present value Net present value (NPV) Expected retum (IRR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts