Question: Team Project M V.1 Team Project Module V.1.1: The Souper Bowl Kitchen (SBK) plans to purchase a new refrigerator The SBK has two options as

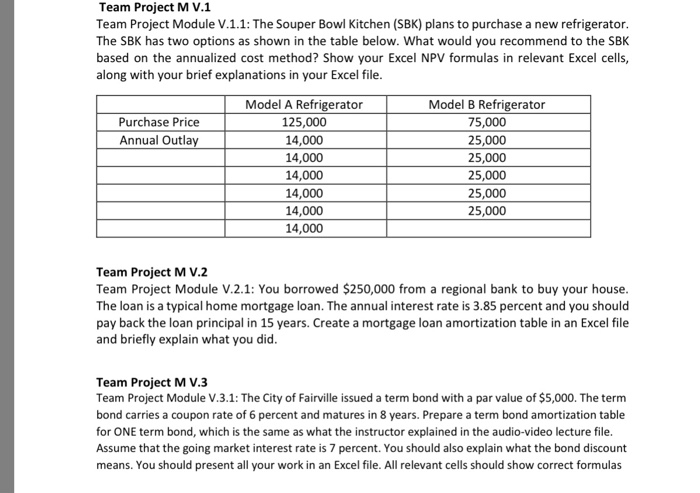

Team Project M V.1 Team Project Module V.1.1: The Souper Bowl Kitchen (SBK) plans to purchase a new refrigerator The SBK has two options as shown in the table below. What would you recommend to the SBK based on the annualized cost method? Show your Excel NPV formulas in relevant Excel cells, along with your brief explanations in your Excel file Model A Refrigerator 125,000 14,000 14,000 14,000 14,000 14,000 14,000 Model B Refrigerator 75,000 25,000 25,000 25,000 25,000 25,000 Purchase Price Annual Outla Team Project M V.2 Team Project Module V.2.1: You borrowed $250,000 from a regional bank to buy your house The loan is a typical home mortgage loan. The annual interest rate is 3.85 percent and you should pay back the loan principal in 15 years. Create a mortgage loan amortization table in an Excel file and briefly explain what you did Team Project M V.3 Team Project Module V.3.1: The City of Fairville issued a term bond with a par value of $5,000. The ternm bond carries a coupon rate of 6 percent and matures in 8 years. Prepare a term bond amortization table for ONE term bond, which is the same as what the instructor explained in the audio-video lecture file Assume that the going market interest rate is 7 percent. You should also explain what the bond discount means. You should present all your work in an Excel file. All relevant cells should show correct formulas Team Project M V.1 Team Project Module V.1.1: The Souper Bowl Kitchen (SBK) plans to purchase a new refrigerator The SBK has two options as shown in the table below. What would you recommend to the SBK based on the annualized cost method? Show your Excel NPV formulas in relevant Excel cells, along with your brief explanations in your Excel file Model A Refrigerator 125,000 14,000 14,000 14,000 14,000 14,000 14,000 Model B Refrigerator 75,000 25,000 25,000 25,000 25,000 25,000 Purchase Price Annual Outla Team Project M V.2 Team Project Module V.2.1: You borrowed $250,000 from a regional bank to buy your house The loan is a typical home mortgage loan. The annual interest rate is 3.85 percent and you should pay back the loan principal in 15 years. Create a mortgage loan amortization table in an Excel file and briefly explain what you did Team Project M V.3 Team Project Module V.3.1: The City of Fairville issued a term bond with a par value of $5,000. The ternm bond carries a coupon rate of 6 percent and matures in 8 years. Prepare a term bond amortization table for ONE term bond, which is the same as what the instructor explained in the audio-video lecture file Assume that the going market interest rate is 7 percent. You should also explain what the bond discount means. You should present all your work in an Excel file. All relevant cells should show correct formulas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts