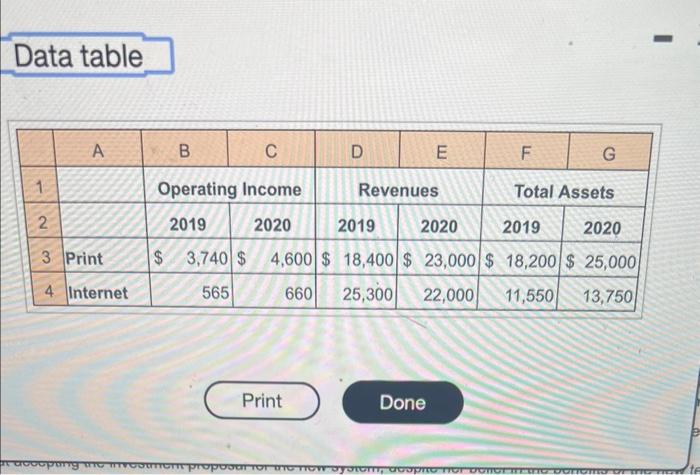

Question: Tech Information Group has two major divisions: print and Internet. Summary financial data (in millions) for 2019 and 2020 are as follows: Data table begin{tabular}{|c|c|c|c|c|c|c|c|}

Tech Information Group has two major divisions: print and Internet. Summary financial data (in millions) for 2019 and 2020 are as follows:

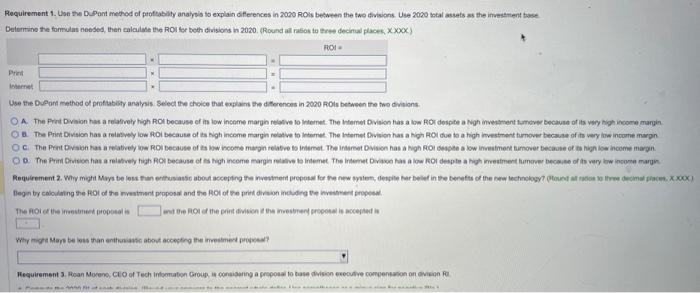

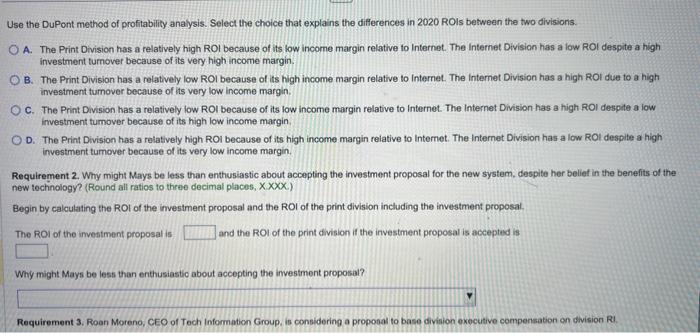

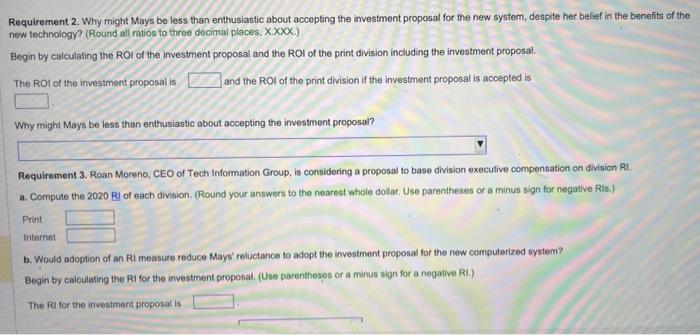

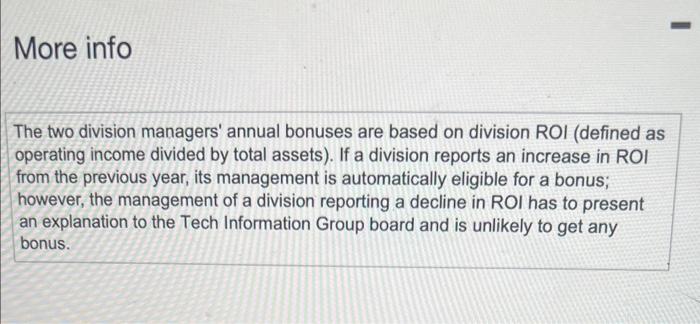

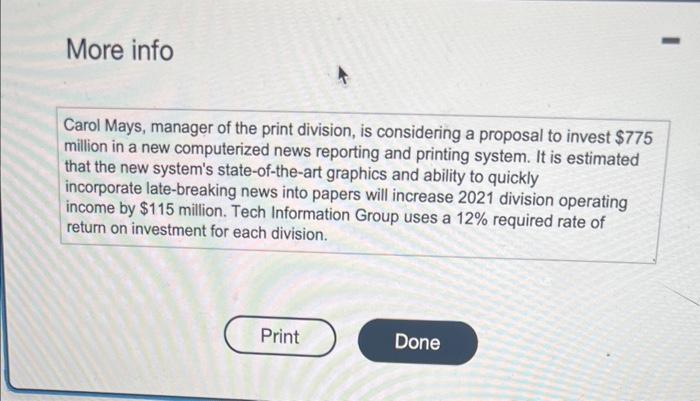

Data table \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & A & B & C & D & E & F & G \\ \hline 1 & & \multicolumn{2}{|c|}{ Operating Income } & \multicolumn{2}{c|}{ Revenues } & \multicolumn{2}{c|}{ Total Assets } \\ \hline 2 & & 2019 & 2020 & 2019 & 2020 & 2019 & 2020 \\ \hline 3 & Print & $3,740 & $4,600 & $18,400 & $23,000 & $18,200 & $25,000 \\ \hline 4 & internet & 565 & 660 & 25,300 & 22,000 & 11,550 & 13,750 \\ \hline \end{tabular} Print Done Requirement 1. Use the Du Pont methed of profthabilty anatytis to explain diferences in 2000 Rois between the two fivisons. Use 2080 total assats as the investment tose Deternino the formolas needed, then calculase the ROr fer beth divisions in 2020 , (Round all ratios to tree decinual places, XXXX.) Wse the Dveront method of profiabily anatyis Select the choice that explains te diterences in 2000 Pois between the fwo divions. The Roict the imsubtent proposat is ant tie fol of the print fivision 2 the investhend proposal is acceshed in Use the DuPont method of profitability analysis. Select the choice that explains the differences in 2020 ROIs between the two divisions. A. The Print Division has a relatively high ROI because of its low income margin relative to Internet. The Internet Division has a low ROI despite a high investment tumbver because of its very high income margin. B. The Print Division has a relatively low ROI because of its high income margin relative to Internet. The Internet Division has a high ROI due to a high investment tumover because of its very low income margin. C. The Print Division has a relatively low ROI because of its low income margin relative to Internet. The Internet Division has a high ROI despite a low imvestment tumover because of its high low income margin, D. The Print Division has a relatively high ROI because of its high income margin relative to Internet. The internet Division has a low ROI despite a high investment tumover because of its very low income margin. Requirement 2. Why might Mays be less than enthusiastic about accepting the irvestment proposal for the new system, despite her belief in the benefits of the new tochnology? (Round all ratios to three decimal places, X ) Begin by calculating the ROI of the investment proposal and the ROI of the print division including the investment proposal. The ROI of the imvesiment proposal is and the ROl of the print division if the investment proposal is accepted is Why might Mays be less than enthusiastic about accepting the investment proposal? Requirement 2. Why might Mays be less than enthusiastic about accepting the investment proposal for the new system, despite her bellef in the benefits of the new technology? (Round all ratios to three decimai places, XX.) Begin by calculating the ROI of the investment proposal and the ROI of the print division including the investment proposal. The ROI of the investment proposal is and the ROl of the print division if the investment proposal is accepted is Why might Mays be less than enthusiastic about accepting the investment proposal? Requirement 3. Roan Moreno, CEO of Tech Information Group, is considering a proposal to base division executive compensation on division RI. a. Compute the 2020RI of each division. (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative Ris.) Print Internet b. Would adoption of an RI measure reduce Mays' reluctance to adopt the investment proposal for the new computerized system? Begin by calculating the RI for the irvestment proposal. (Use parentheses or a minus sign for a negative RI.) The RI for the investment propostal is b. Would adoption of an RI measure reduce Mays' reluctance to adopt the investment proposal for the new computerized system? Begin by calculating the RI for the investment proposal. (Use parentheses or a minus sign for a negativo RI.) The Ri for the imvestment proposal is Investing in the fast-speed printing press will have the Print Division's residual income. Requirement 4. Moreno is concerned that the focus on annual ROl could have an adverse long-run effect on Tech information Group's customers. What other measurements, If any, do you recommend that Moreno use? Explain briefly. A. Moreno could consider using RI. The use of RI motivates managers to accept ary project that makes a positive contnbution to net income after the cost of the invested capital is taken into account. Making such investments will have a positive effect on Tech information Group's customers. B. Moreno may want to consider nonfinancial measures such as newspaper subscription levels, internet audience size, repeat purchase partems, and market share. These measures will require managers to invest in areas that have favorable long-run effects on Tech information Group's customers. C. Both A and B. D. None of the above. There are no further recommendations. Moreno should only focus on annual ROI. More info The two division managers' annual bonuses are based on division ROI (defined as operating income divided by total assets). If a division reports an increase in ROI from the previous year, its management is automatically eligible for a bonus; however, the management of a division reporting a decline in ROI has to present an explanation to the Tech Information Group board and is unlikely to get any bonus. More info Carol Mays, manager of the print division, is considering a proposal to invest $775 million in a new computerized news reporting and printing system. It is estimated that the new system's state-of-the-art graphics and ability to quickly incorporate late-breaking news into papers will increase 2021 division operating income by $115 million. Tech Information Group uses a 12% required rate of return on investment for each division

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts