Question: TechLink is currently experiencing rapid growth. It is expected that dividends are going to increase by 8% each year in the coming six years,

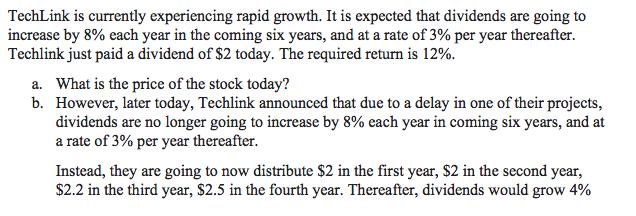

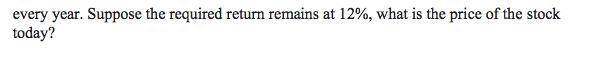

TechLink is currently experiencing rapid growth. It is expected that dividends are going to increase by 8% each year in the coming six years, and at a rate of 3% per year thereafter. Techlink just paid a dividend of $2 today. The required return is 12%. a. What is the price of the stock today? b. However, later today, Techlink announced that due to a delay in one of their projects, dividends are no longer going to increase by 8% each year in coming six years, and at a rate of 3% per year thereafter. Instead, they are going to now distribute $2 in the first year, $2 in the second year, $2.2 in the third year, $2.5 in the fourth year. Thereafter, dividends would grow 4% every year. Suppose the required return remains at 12%, what is the price of the stock today?

Step by Step Solution

3.44 Rating (180 Votes )

There are 3 Steps involved in it

a Price of the Stock Today To find the price of the stock today we can use the dividend discount mod... View full answer

Get step-by-step solutions from verified subject matter experts