Question: Tect Question 17 Consider the data provided in the table below for a portfolio of assets A and B. The portfolio weights and variances are

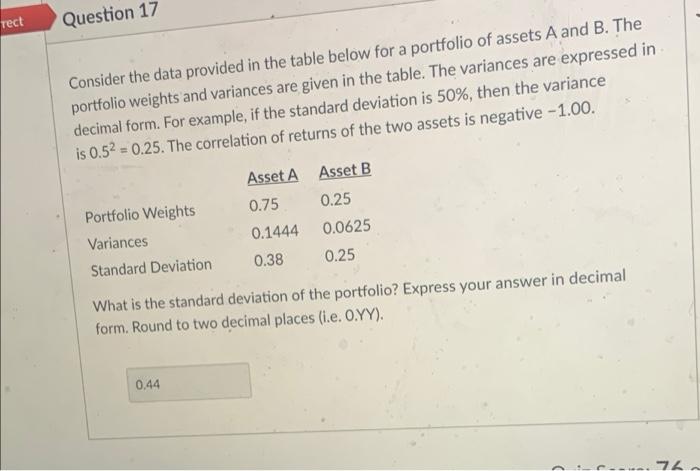

Tect Question 17 Consider the data provided in the table below for a portfolio of assets A and B. The portfolio weights and variances are given in the table. The variances are expressed in decimal form. For example, if the standard deviation is 50%, then the variance is 0.52 = 0.25. The correlation of returns of the two assets is negative -1.00. Asset A Asset B Portfolio Weights 0.75 0.25 Variances 0.1444 0.0625 Standard Deviation 0.38 0.25 What is the standard deviation of the portfolio? Express your answer in decimal form. Round to two decimal places (i.e. O.YY). 0.44 72 > 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts