Question: Tempe Inc. is considering four mutually exclusive public projects. The capital investment requirements, annual operating & maintenance (O&M) costs, and salvage values of these

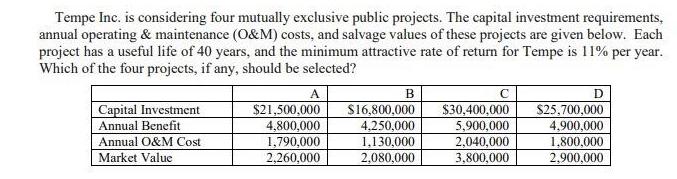

Tempe Inc. is considering four mutually exclusive public projects. The capital investment requirements, annual operating & maintenance (O&M) costs, and salvage values of these projects are given below. Each project has a useful life of 40 years, and the minimum attractive rate of return for Tempe is 11% per year. Which of the four projects, if any, should be selected? A Capital Investment Annual Benefit Annual O&M Cost Market Value $21,500,000 4,800,000 1,790,000 2,260,000 B $16,800,000 4,250,000 1,130,000 2,080,000 C $30,400,000 5,900,000 2,040,000 3,800,000 D $25,700,000 4,900,000 1.800,000 2,900,000

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

To determine which projects should be selected we need to calculate the net present value NPV of eac... View full answer

Get step-by-step solutions from verified subject matter experts