Question: Temporal Method? (2 - Marks) Cast Study: 5 Dr. Fatma Saleh Ali Al Harrani was closely associated with Bank of Japan, Bank of Enrope, State

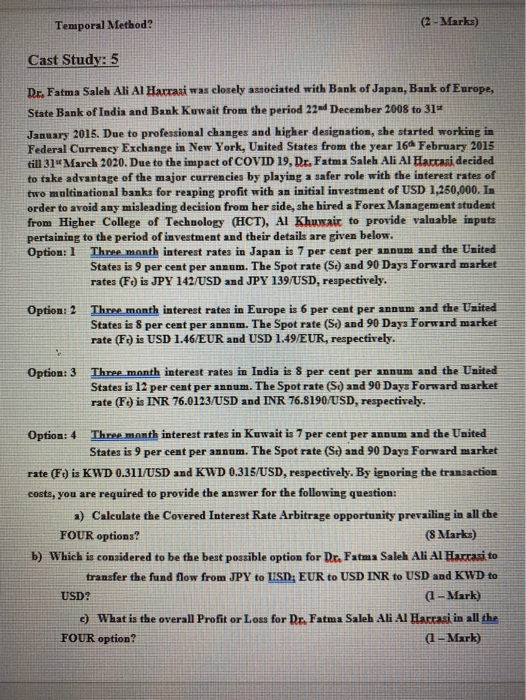

Temporal Method? (2 - Marks) Cast Study: 5 Dr. Fatma Saleh Ali Al Harrani was closely associated with Bank of Japan, Bank of Enrope, State Bank of India and Bank Kuwait from the period 22 December 2008 to 31* January 2015. Due to professional changes and higher designation, she started working in Federal Currency Exchange in New York, United States from the year 16 February 2015 till 31 March 2020. Due to the impact of COVID 19, Dr. Fatma Saleh Ali Al Hattasi decided to take advantage of the major currencies by playing a safer role with the interest rates of two multinational banks for reaping profit with an initial investment of USD 1,250,000. In order to avoid any misleading decision from her side, she hired a Forex Management student from Higher College of Technology (HCT), Al Khuwair to provide valuable inputs pertaining to the period of investment and their details are given below. Option: 1 Three month interest rates in Japan is 7 per cent per annum and the United States is 9 per cent per annum. The Spot rate (Sc) and 90 Days Forward market rates (F) is JPY 142/USD and JPY 139/USD, respectively. Option: 2 Three month interest rates in Europe is 6 per cent per annum and the United States is 8 per cent per annum. The Spot rate (Sc) and 90 Days Forward market rate (Fe) is USD 1.46/EUR and USD 1.49/EUR, respectively. Option: 3 Three month interest rates in India is 8 per cent per annum and the United States is 12 per cent per annum. The Spot rate (S) and 90 Days Forward market rate (F) is INR 76.0123/USD and INR 76.8190/USD, respectively. Option: 4 Three month interest rates in Kuwait is 7 per cent per annum and the United States is 9 per cent per annum. The Spot rate (S.) and 90 Days Forward market rate (Fe) is KWD 0.311/USD and KWD 0.315/USD, respectively. By ignoring the transaction costs, you are required to provide the answer for the following question: a) Calculate the Covered Interest Rate Arbitrage opportunity prevailing in all the FOUR options? (8 Marks) b) Which is considered to be the best possible option for Dr. Fatma Saleh Ali Al Hamraai to transfer the fund flow from JPY to UISDEUR to USD INR to USD and KWD to USD? (1 - Mark) c) What is the overall Profit or Loss for Dr. Fatma Saleh Ali Al Haxcasi in all the FOUR option? (1-Mark) Temporal Method? (2 - Marks) Cast Study: 5 Dr. Fatma Saleh Ali Al Harrani was closely associated with Bank of Japan, Bank of Enrope, State Bank of India and Bank Kuwait from the period 22 December 2008 to 31* January 2015. Due to professional changes and higher designation, she started working in Federal Currency Exchange in New York, United States from the year 16 February 2015 till 31 March 2020. Due to the impact of COVID 19, Dr. Fatma Saleh Ali Al Hattasi decided to take advantage of the major currencies by playing a safer role with the interest rates of two multinational banks for reaping profit with an initial investment of USD 1,250,000. In order to avoid any misleading decision from her side, she hired a Forex Management student from Higher College of Technology (HCT), Al Khuwair to provide valuable inputs pertaining to the period of investment and their details are given below. Option: 1 Three month interest rates in Japan is 7 per cent per annum and the United States is 9 per cent per annum. The Spot rate (Sc) and 90 Days Forward market rates (F) is JPY 142/USD and JPY 139/USD, respectively. Option: 2 Three month interest rates in Europe is 6 per cent per annum and the United States is 8 per cent per annum. The Spot rate (Sc) and 90 Days Forward market rate (Fe) is USD 1.46/EUR and USD 1.49/EUR, respectively. Option: 3 Three month interest rates in India is 8 per cent per annum and the United States is 12 per cent per annum. The Spot rate (S) and 90 Days Forward market rate (F) is INR 76.0123/USD and INR 76.8190/USD, respectively. Option: 4 Three month interest rates in Kuwait is 7 per cent per annum and the United States is 9 per cent per annum. The Spot rate (S.) and 90 Days Forward market rate (Fe) is KWD 0.311/USD and KWD 0.315/USD, respectively. By ignoring the transaction costs, you are required to provide the answer for the following question: a) Calculate the Covered Interest Rate Arbitrage opportunity prevailing in all the FOUR options? (8 Marks) b) Which is considered to be the best possible option for Dr. Fatma Saleh Ali Al Hamraai to transfer the fund flow from JPY to UISDEUR to USD INR to USD and KWD to USD? (1 - Mark) c) What is the overall Profit or Loss for Dr. Fatma Saleh Ali Al Haxcasi in all the FOUR option? (1-Mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts