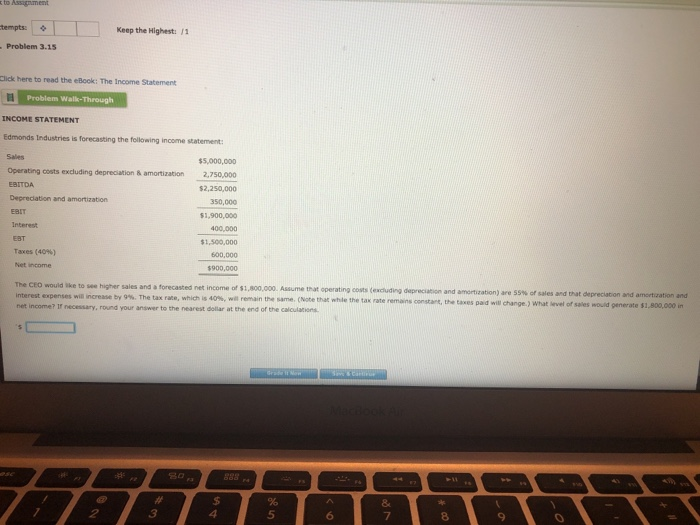

Question: tempts: Keep the Highest: Problem 3.15 Click here to read the eBook: The Income Statement Problem Walk-Through INCOME STATEMENT Edmonds Industries is forecasting the following

tempts: Keep the Highest: Problem 3.15 Click here to read the eBook: The Income Statement Problem Walk-Through INCOME STATEMENT Edmonds Industries is forecasting the following income statement 5,000,000 Operating costs excluding depreciation & amortization 2,750,000 $2,250,000 350,000 1,900,000 $1,500,000 600,000 900,000 Taxes (40%) The CEO would ike to see higher sales and a forecasted net income of $1,800,000. Assume that operating costs (exctluding depreciation and interest expenses win ncrease by 9%. The tax rate, which is 40%, we remain th, same. (Note that whle the tax rate remains consta t, th, taxes pad wr net income? If necessary, round your answer to the nearest dollar at the end of the calculations amortization) are SS% of sales and that depreciation and amortization and will change.) What level of sales wouid generate $1,800,000 in 8 2 3 5 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts