Question: Term Answer Description A. The general term that describes the portion of an asset's total expected return that is greater than the return earned on

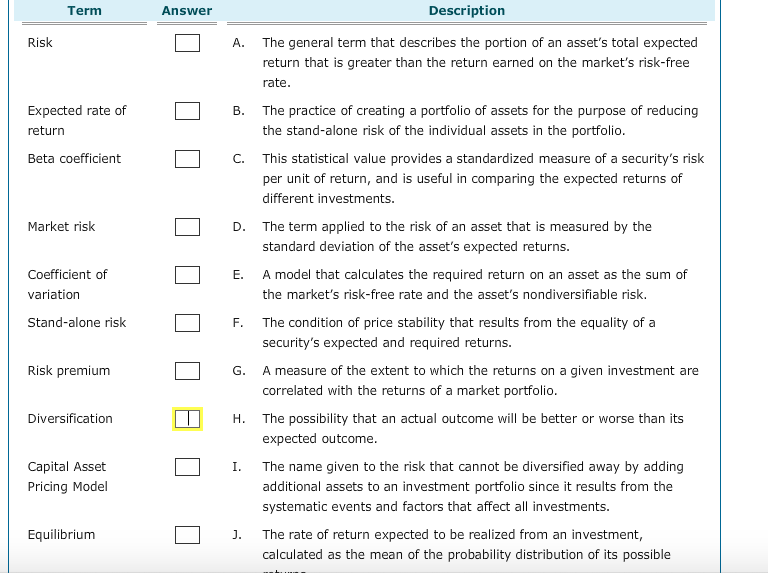

Term Answer Description A. The general term that describes the portion of an asset's total expected return that is greater than the return earned on the market's risk-free rate Expected rate of return B. The practice of creating a portfolio of assets for the purpose of reducing the stand-alone risk of the individual assets in the portfolio Beta coefficient C. This statistical value provides a standardized measure of a security's risk per unit of return, and is useful in comparing the expected returns of different investments. Market risk D. The term applied to the risk of an asset that is measured by the standard deviation of the asset's expected returns. E. A model that calculates the required return on an asset as the sum of the market's risk-free rate and the asset's nondiversifiable risk. ficient of variation Stand-alone risk F. The condition of price stability that results from the equality ofa security's expected and required returns Risk premium G. A measure of the extent to which the returns on a given investment are correlated with the returns of a market portfolio H. The possibility that an actual outcome will be better or worse than its expected outcome Capital Asset Pricing Model I. The name given to the risk that cannot be diversified away by adding additional assets to an investment portfolio since it results from the systematic events and factors that affect all investments. Equilibrium J. The rate of return expected to be realized from an investment, calculated as the mean of the probability distribution of its possible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts