Question: Term Answer Description A. This asset is commonly also known as non-owner occupied and is treated as an investment asset for the investor to earn

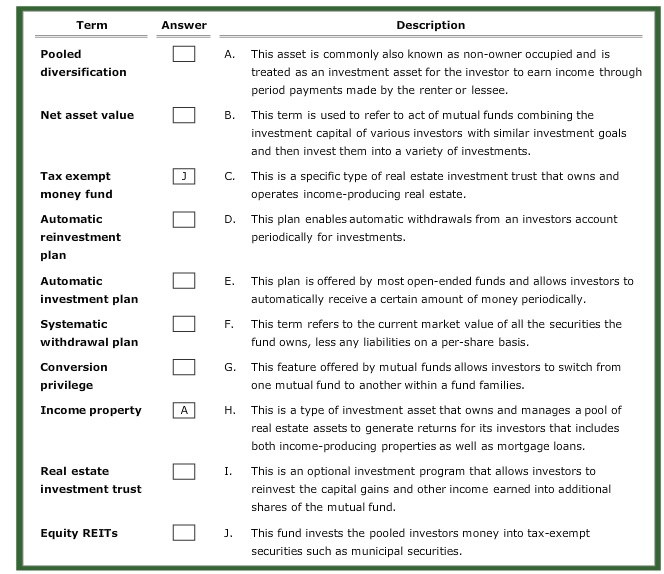

Term Answer Description A. This asset is commonly also known as non-owner occupied and is treated as an investment asset for the investor to earn income through period payments made by the renter or lessee. This term is used to refer to act of mutual funds combining the investment capital of various investors with similar investment goals and then invest them into a variety of investments This is a specific type of real estate investment trust that owns and operates income-producing real estate This plan enables automatic withdrawals from an investors account periodically for investments Pooled diversification Net asset value B. Tax exempt money fund Automatic reinvestment plan Automatic investment plan Systematic withdrawal plan Conversion privilege Income property C. D. E. This plan is offered by most open-ended funds and allows investors to automatically receive a certain amount of money periodically This term refers to the current market value of all the securities the fund owns, less any liabilities on a per-share basis. This feature offered by mutual funds allows investors to switch from one mutual fund to another within a fund families. F. G. H. This is a type of investment asset that owns and manages a pool of real estate assets to generate returns for its investors that includes both income-producing properties as well as mortgage loans. This is an optional investment program that allows investors to reinvest the capital gains and other income earned into additional shares of the mutual fund Real estate I. investment trust Equity REITs 1. This fund invests the pooled investors money into tax-exempt securities such as municipal securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts