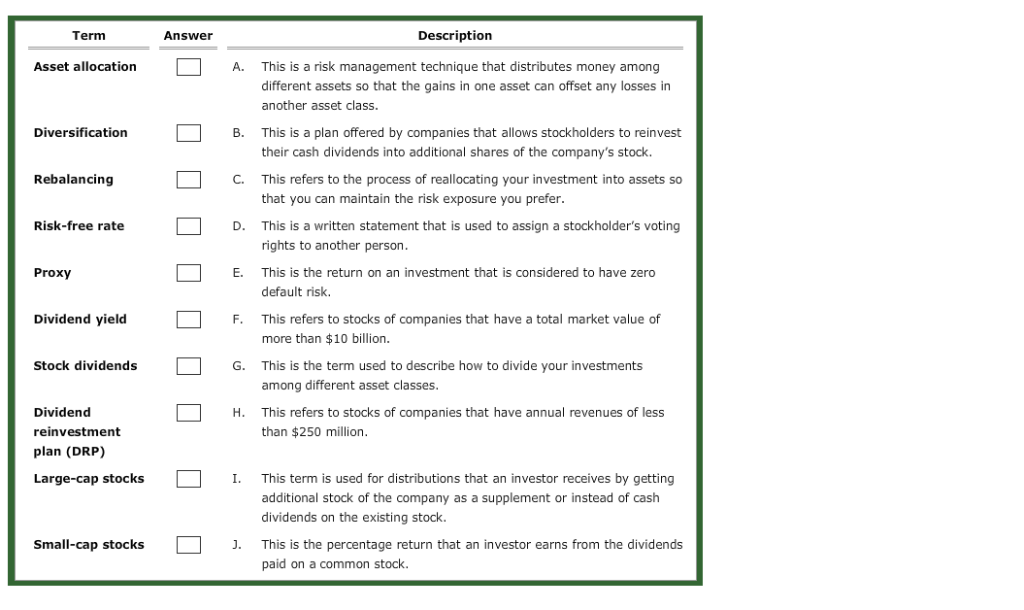

Question: Term Answer Description A. This is a risk management technique that distributes money among different assets so that the gains in one asset can offset

Term Answer Description A. This is a risk management technique that distributes money among different assets so that the gains in one asset can offset any losses in another asset class. Diversification B. This is a plan offered by companies that allows stockholders to reinvest their cash dividends into additional shares of the company's stock Rebalancing C. This refers to the process of reallocating your investment into assets so that you This is a written statement that is used to assign a stockholder's voting rights to another person This is the return on an investment that is considered to have zero default risk. can maintain the risk exposure you prefer Risk-free rate D. Proxy E. Dividend yield F. This refers to stocks of companies that have a total market value of more than $10 billion. Stock dividendsG This is the term used to describe how to divide your investments among different asset classes This refers to stocks of companies that have annual revenues of less than $250 million Dividend reinvestment plan (DRP) Large-cap stocks H. I. This term is used for distributions that an investor receives by getting additional stock of the company as a supplement or instead of cash dividends on the existing stock. Small-cap stocks . This is the percentage return that an investor earns from the dividends paid on a common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts