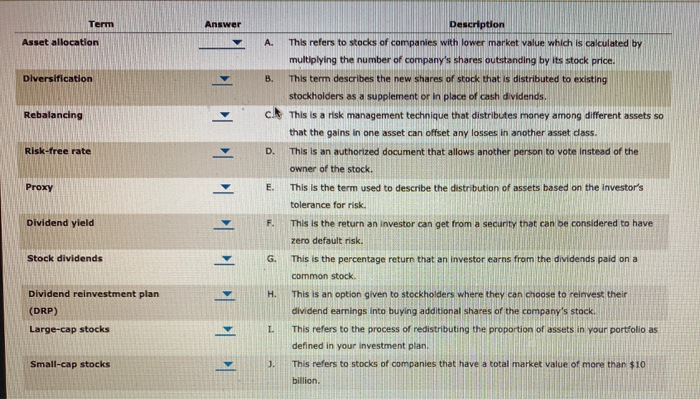

Question: Answer Asset allocation A Diversification B. Rebalancing C. Risk-free rate D. Proxy E. Description This refers to stocks of companies with lower market value which

Answer Asset allocation A Diversification B. Rebalancing C. Risk-free rate D. Proxy E. Description This refers to stocks of companies with lower market value which is calculated by multiplying the number of company's shares outstanding by its stock price. This term describes the new shares of stock that is distributed to existing stockholders as a supplement or in place of cash dividen This is a risk management technique that distributes money among different assets so that the gains in one asset can offset any losses in another asset dass This is an authorized document that allows another person to vote instead of the owner of the stock. This is the term used to describe the distribution of assets based on the investor's tolerance for risk. This is the return an investor can get from a security that can be considered to have zero default risk. This is the percentage return that an investor earns from the dividends paid on a common stock This is an option given to stockholders where they can choose to reinvest their dividend earnings into buying additional shares of the company's stock. This refers to the process of redistributing the proportion of assets in your portfolio as defined in your investment plan. This refers to stocks of companies that have a total market value of more than $10 billion. Dividend yield Stock dividends k Dividend reinvestment plan (DRP) Large-cap stocks Small-cap stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts