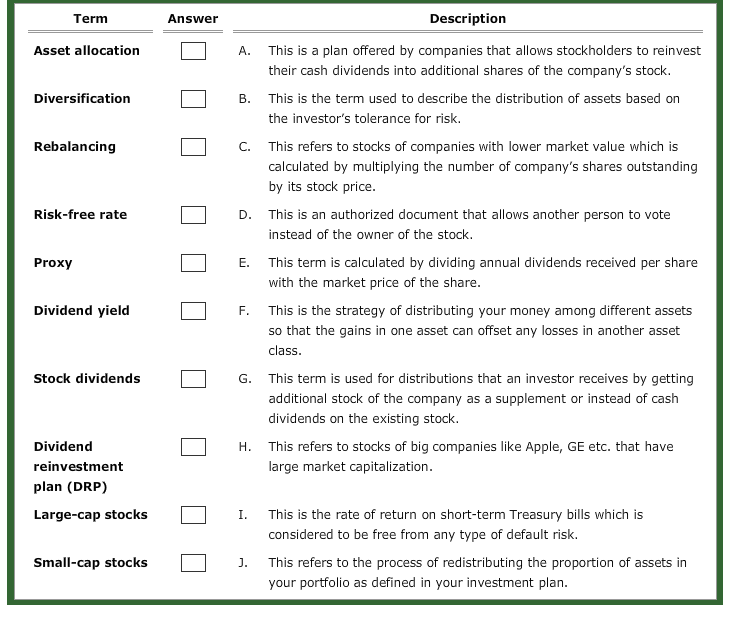

Question: Term Answer Description Asset allocation A. This is a plan offered by companies that allows stockholders to reinvest their cash dividends into additional shares of

Term Answer Description Asset allocation A. This is a plan offered by companies that allows stockholders to reinvest their cash dividends into additional shares of the company's stock This is the term used to describe the distribution of assets based on the investor's tolerance for risk Diversification B. Rebalancing C. This refers to stocks of companies with lower market value which is calculated by multiplying the number of company's shares outstanding by its stock price This is an authorized document that allows another person to vote instead of the owner of the stock D. This term is calculated by dividing annual dividends received per share with the market price of the share This is the strategy of distributing your money among different assets so that the gains in one asset can offset any losses in another asset class Proxy E. F. Stock dividends G. This term is used for distributions that an investor receives by getting additional stock of the company as a supplement or instead of cash dividends on the existing stock This refers to stocks of big companies like Apple, GE etc. that have large market capitalization Dividend reinvestment plan (DRP) H. I. This is the rate of return on short-term Treasury bills which is considered to be free from any type of default risk. Small-cap stocks . This refers to the process of redistributing the proportion of assets in your portfolio as defined in your investment plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts