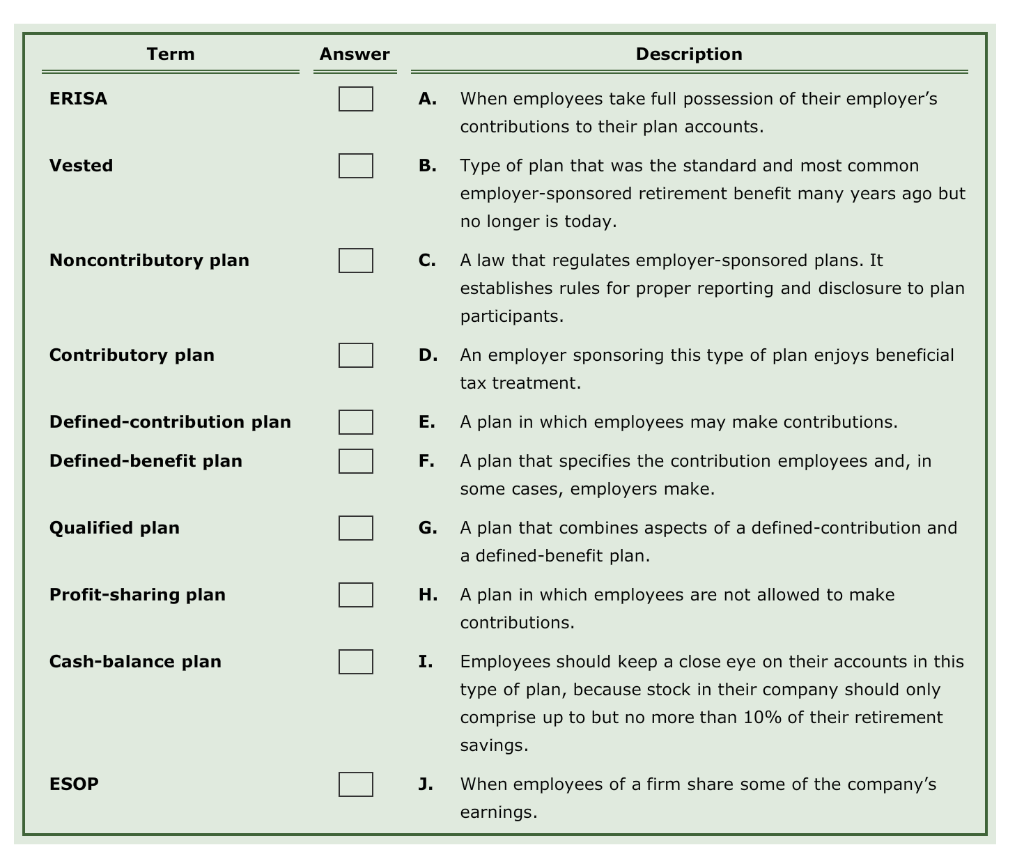

Question: Term Answer Description ERISA A. When employees take full possession of their employer's contributions to their plan accounts. Vested 0 B. Type of plan that

Term Answer Description ERISA A. When employees take full possession of their employer's contributions to their plan accounts. Vested 0 B. Type of plan that was the standard and most common employer-sponsored retirement benefit many years ago but no longer is today. Noncontributory plan 0 A law that regulates employer-sponsored plans. It establishes rules for proper reporting and disclosure to plan participants. Contributory plan 0 D. An employer sponsoring this type of plan enjoys beneficial tax treatment. A plan in which employees may make contributions. Defined-contribution plan 0 E. Defined-benefit plan F. A plan that specifies the contribution employees and, in some cases, employers make. Qualified plan 0 A plan that combines aspects of a defined contribution and a defined-benefit plan. Profit-sharing plan 0 H. A A plan in which employees are not allowed to make contributions. Cash-balance plan 0 Employees should keep a close eye on their accounts in this type of plan, because stock in their company should only comprise up to but no more than 10% of their retirement savings. ESOP When employees of a firm share some of the company's earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts