Question: Term structure for a is s1 = 2.50%; s2= 3.00 %; s3=3.50% need help with b 3 Suppose the following bonds are trading in the

Term structure for a is

s1 = 2.50%; s2= 3.00 %; s3=3.50%

need help with b

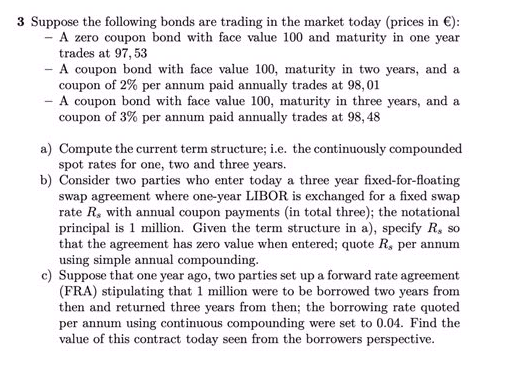

3 Suppose the following bonds are trading in the market today (prices in ): - A zero coupon bond with face value 100 and maturity in one year trades at 97,53 - A coupon bond with face value 100, maturity in two years, and a coupon of 2% per annum paid annually trades at 98,01 - A coupon bond with face value 100, maturity in three years, and a coupon of 3% per annum paid annually trades at 98,48 a) Compute the current term structure; i.e. the continuously compounded spot rates for one, two and three years. b) Consider two parties who enter today a three year fixed-for-floating swap agreement where one-year LIBOR is exchanged for a fixed swap rate Rs with annual coupon payments (in total three); the notational principal is 1 million. Given the term structure in a), specify R, so that the agreement has zero value when entered; quote R, per annum using simple annual compounding. c) Suppose that one year ago, two parties set up a forward rate agreement (FRA) stipulating that 1 million were to be borrowed two years from then and returned three years from then; the borrowing rate quoted per annum using continuous compounding were set to 0.04. Find the value of this contract today seen from the borrowers perspective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts