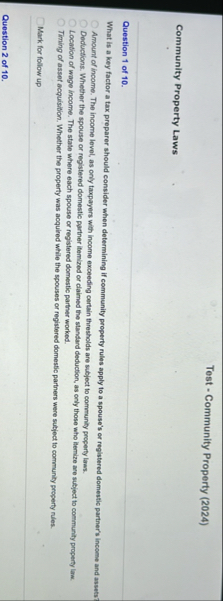

Question: Test - Community Property ( 2 0 2 4 ) Community Property Laws Question 1 of 1 0 . What is a key factor a

Test Community Property

Community Property Laws

Question of

What is a key factor a tax preparer should consider when determining if community property rules apply to a spouse's or registered domestic partner's income and assets?

Amount of income. The income level, as only taxpayers with income exceeding certain thresholds are subject to community property laws.

Deductions. Whether the spouse or registered domestic partner itemized or claimed the standard deduction, as only those who liemize are subject to community property law.

Location of wage income. The state where each spouse or registered domestic partner worked.

Timing of asset acquisition. Whether the property was acquired while the spouses or registered domestic partners were subject to community property rules.

Mark for follow up

Question of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock