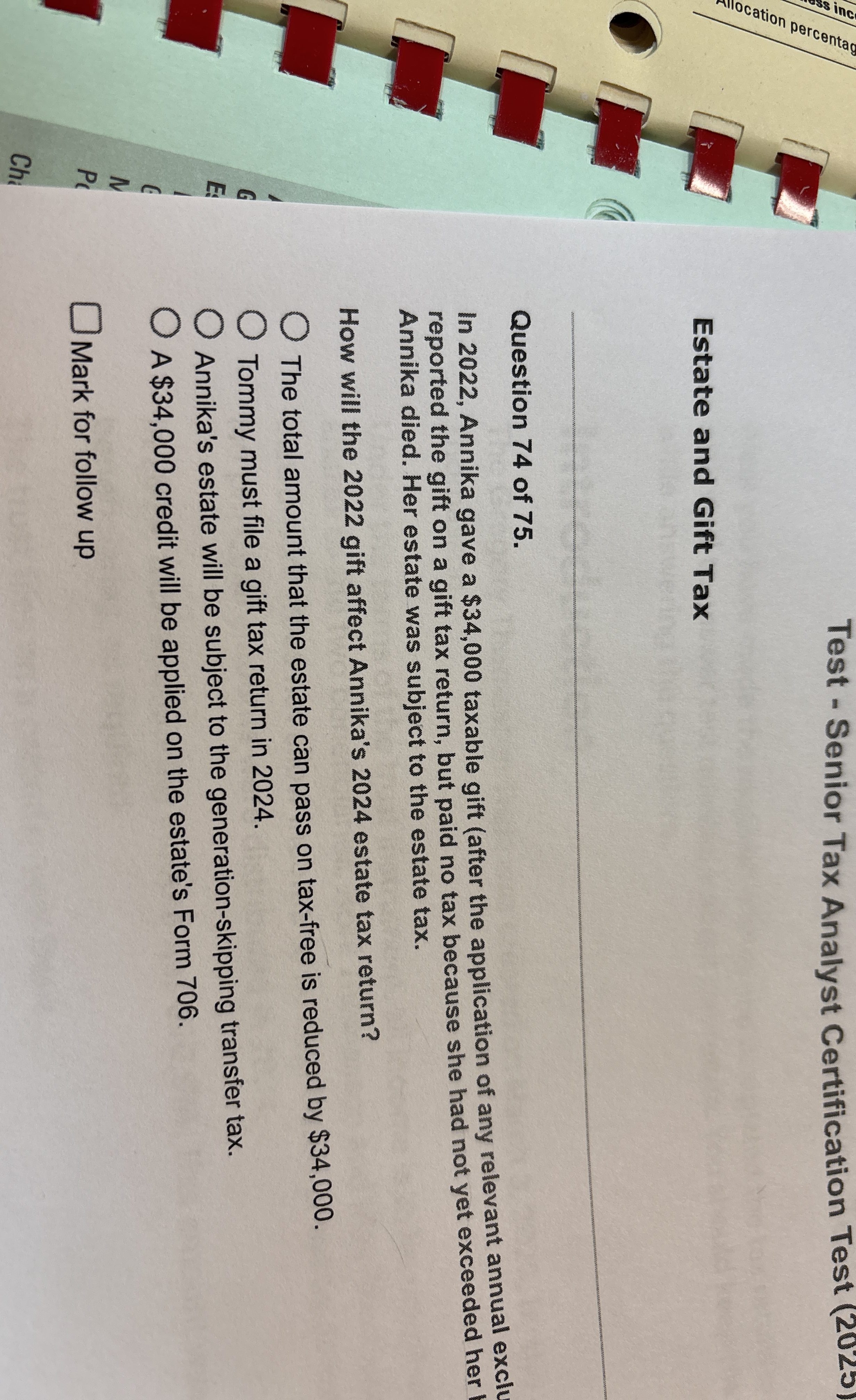

Question: Test - Senior Tax Analyst Certification Test ( 2 0 2 5 ) Estate and Gift Tax Question 7 4 of 7 5 . In

Test Senior Tax Analyst Certification Test

Estate and Gift Tax

Question of

In Annika gave a $ taxable gift after the application of any relevant annual exclu reported the gift on a gift tax return, but paid no tax because she had not yet exceeded her

Annika died. Her estate was subject to the estate tax.

How will the gift affect Annika's estate tax return?

The total amount that the estate can pass on taxfree is reduced by $

Tommy must file a gift tax return in

Annika's estate will be subject to the generationskipping transfer tax.

A $ credit will be applied on the estate's Form

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock