Question: Test - Spotlight on Form 1 0 4 1 ( 2 0 2 4 ) Income and Deductions Question 1 0 of 1 0 .

Test Spotlight on Form

Income and Deductions

Question of

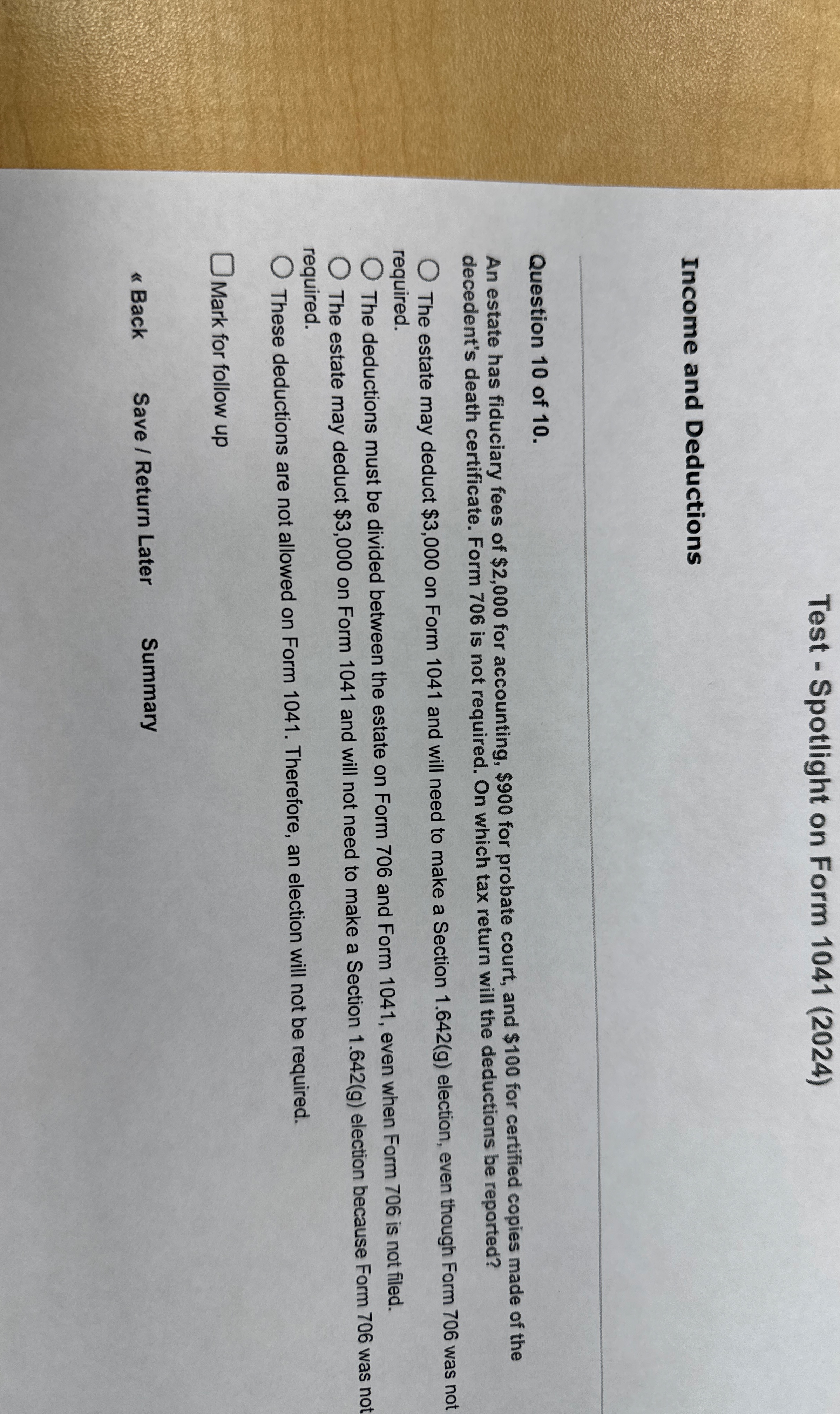

An estate has fiduciary fees of $ for accounting, $ for probate court, and $ for certified copies made of the decedent's death certificate. Form is not required. On which tax return will the deductions be reported?

The estate may deduct $ on Form and will need to make a Section election, even though Form was not required.

The deductions must be divided between the estate on Form and Form even when Form is not filed.

The estate may deduct $ on Form and will not need to make a Section election because Form was not required.

These deductions are not allowed on Form Therefore, an election will not be required.

Mark for follow up

Back

Save Return Later

Summary

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock