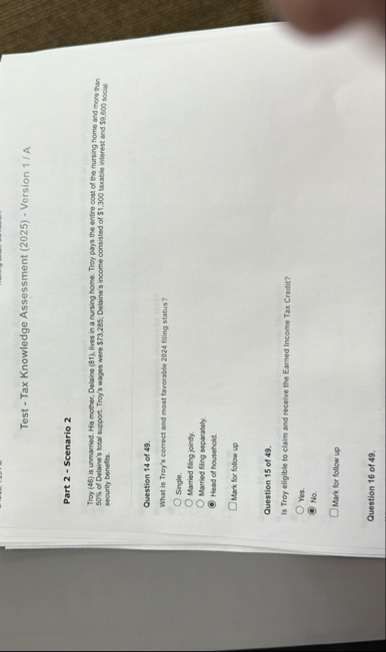

Question: Test - Tax Knowledge Assessment ( 2 0 2 5 ) - Version 1 / A Part 2 - Scenario 2 Troy ( 4 5

Test Tax Knowledge Assessment Version A

Part Scenario

Troy is unmarried. His mother, Delaine lives in a nursing home. Troy pays the entire cost of the nursing home and more than of Delaine's total support. Troy's wages were $; Delaine's income consisted of $ taxable interest and $ social security benefits.

Question of

What is Troy's correct and most favorable filling status?

Single.

Married filing jointly.

Married filing separately.

Head of household.

Mark for follow up

Question of

Is Troy eligible to claim and receive the Earned Income Tax Credit?

Yes.

No

Mark for follow up

Question of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock